Class 12 Expenditure Method Solutions | Prepared by CHK Students

The Expenditure Method is one of the most important approaches to calculate National Income in Class 12 Economics. For many students, solving questions using this method can be tricky due to multiple components and adjustments. To make learning easier, our CHK Student Keshav Khandelwal has prepared step-by-step solutions that simplify the entire process.

What is the Expenditure Method?

The Expenditure Method measures the final value of goods and services produced in a country by calculating total expenditure incurred by households, businesses, government, and the foreign sector.

In simple terms, it adds up all final expenditures to arrive at National Income.

Formula:

GDP (at market price)=C+I+G+(X−M)GDP \ (at\ market\ price) = C + I + G + (X – M)

Where:

-

C = Private Final Consumption Expenditure

-

I = Gross Domestic Capital Formation (Investment)

-

G = Government Final Consumption Expenditure

-

X – M = Net Exports (Exports – Imports)

Steps to Solve Expenditure Method Questions

-

List all expenditure items given in the question.

-

Identify and exclude intermediate consumption (only final expenditure is counted).

-

Add private consumption, government expenditure, and investment.

-

Adjust net exports (X – M).

-

Deduct depreciation and net factor income from abroad (if asked).

-

Arrive at Net National Income at Factor Cost (NNI at FC).

Here’s the Solutions –

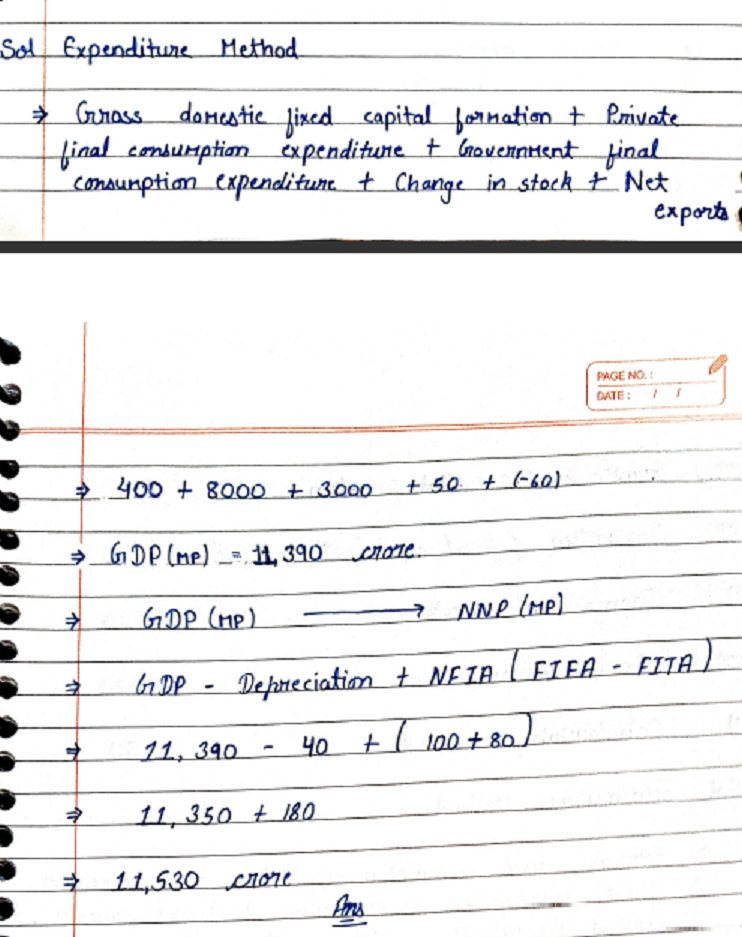

1. Calculate Net National Product at Market Price:

| Items | (₹ in crore) |

| 1. Gross domestic fixed capital formation | 400 |

| 2. Private final consumption expenditure | 8000 |

| 3. Government final consumption expenditure | 3000 |

| 4. Change in Stock | 50 |

| 5. consumption of fixed capital | 40 |

| 6. Net indirect taxes | 100 |

| 7. Net exports | – 60 |

| 8. Net factor income to abroad | – 80 |

| 9. Net current transfers from abroad | 100 |

| 10. Dividend | 100 |

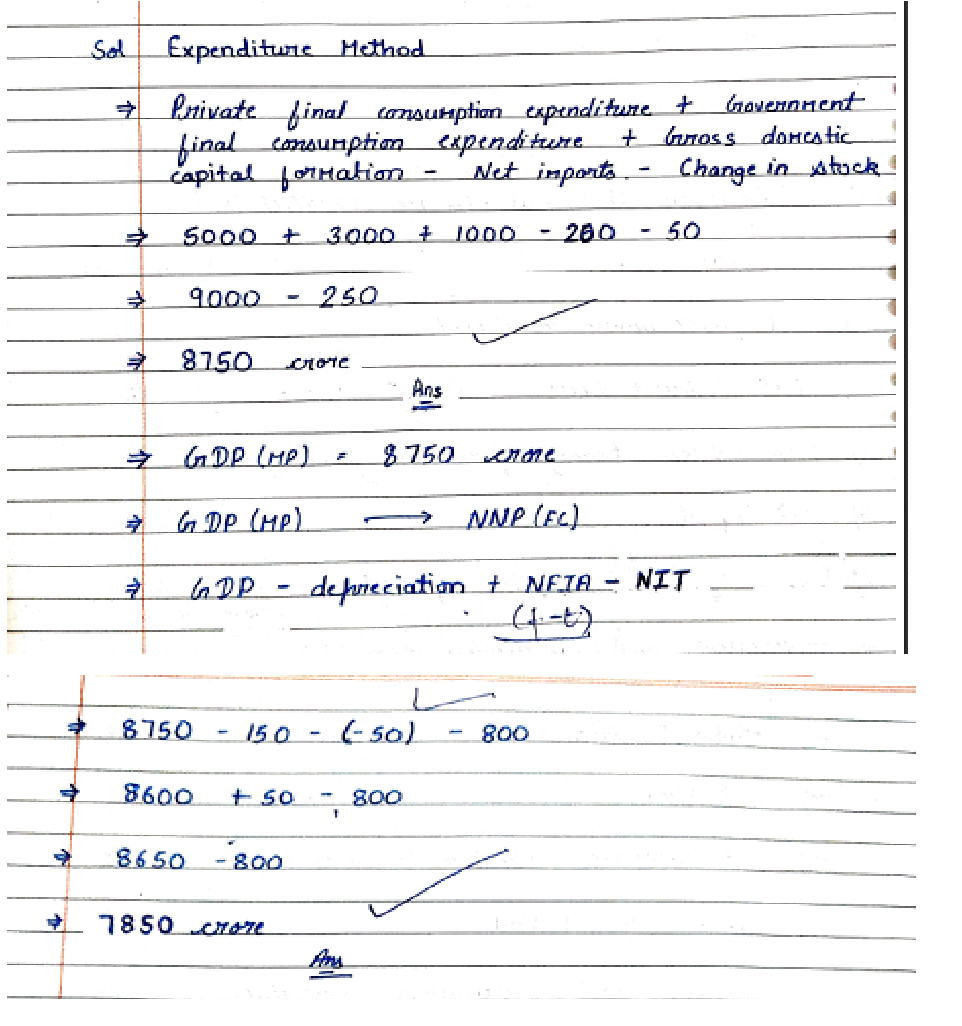

2. Calculate National Income

| Items | (₹ in crore) |

| 1. Net factor income to abroad | – 50 |

| 2. Net indirect taxes | 800 |

| 3. Net current transfers from rest of the world | 100 |

| 4. Net imports | 200 |

| 5. Private final consumption expenditure | 5000 |

| 6. Government final consumption expenditure | 3000 |

| 7. Gross domestic capital formation | 1000 |

| 8. consumption of fixed capital | 150 |

| 9. change in stock | – 50 |

| 10. Mixed income | 4000 |

| 11. Scholarship to students | 80 |

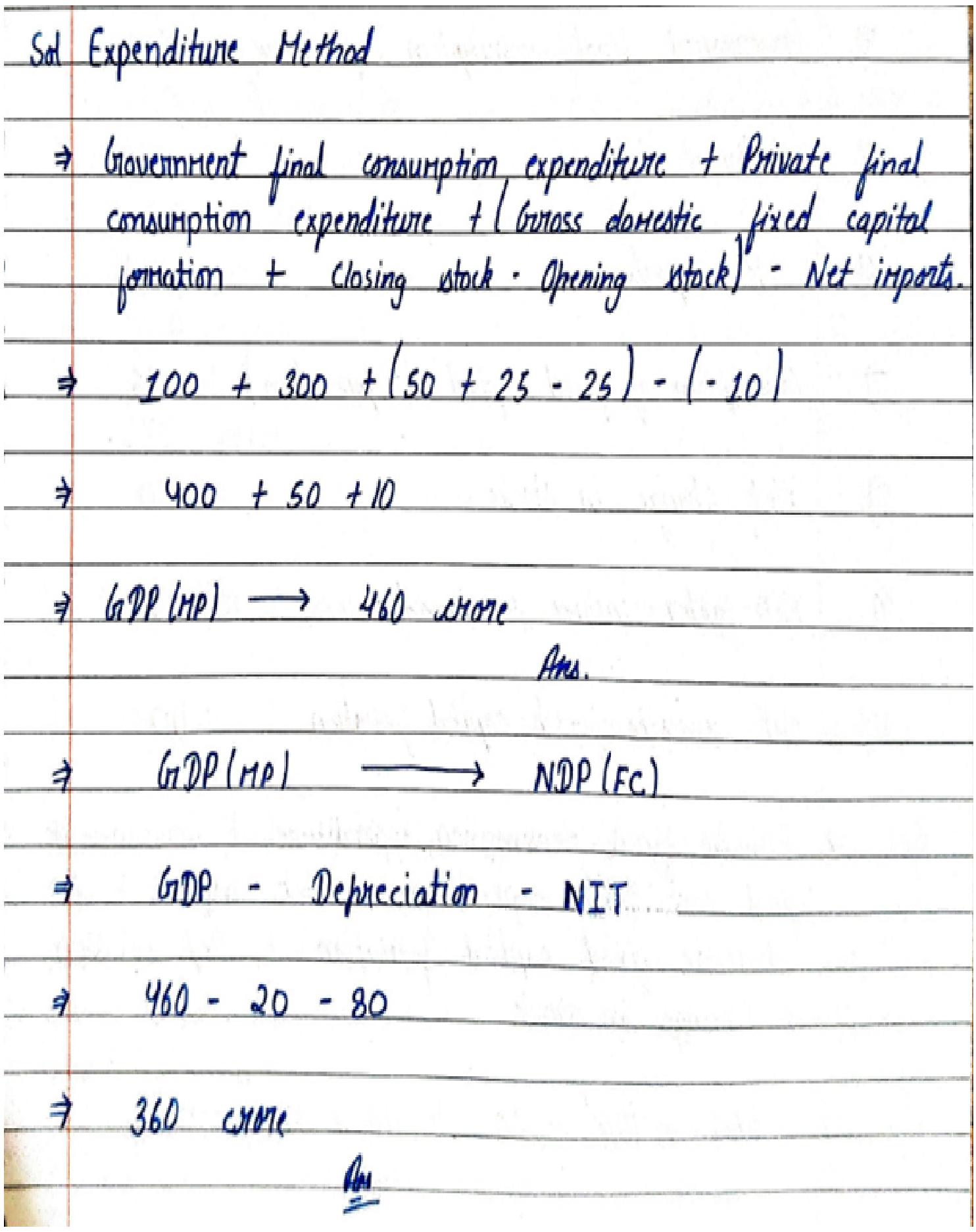

3. Calculate Net Domestic Product at Factor Cost

| Items | (₹ in crore) |

| 1. Private final consumption expenditure | 8000 |

| 2. Government final consumption expenditure | 1000 |

| 3. Exports | 70 |

| 4. Imports | 120 |

| 5. Consumption of fixed capital | 60 |

| 6. Gross domestic fixed capital formation | 500 |

| 7. Change in stock | 100 |

| 8. Factor income to abroad | 40 |

| 9. Factor income from abroad | 90 |

| 10. Indirect taxes | 700 |

| 11. Subsidies | 50 |

| 12. Net Current transfers to abraod | (-) 30 |

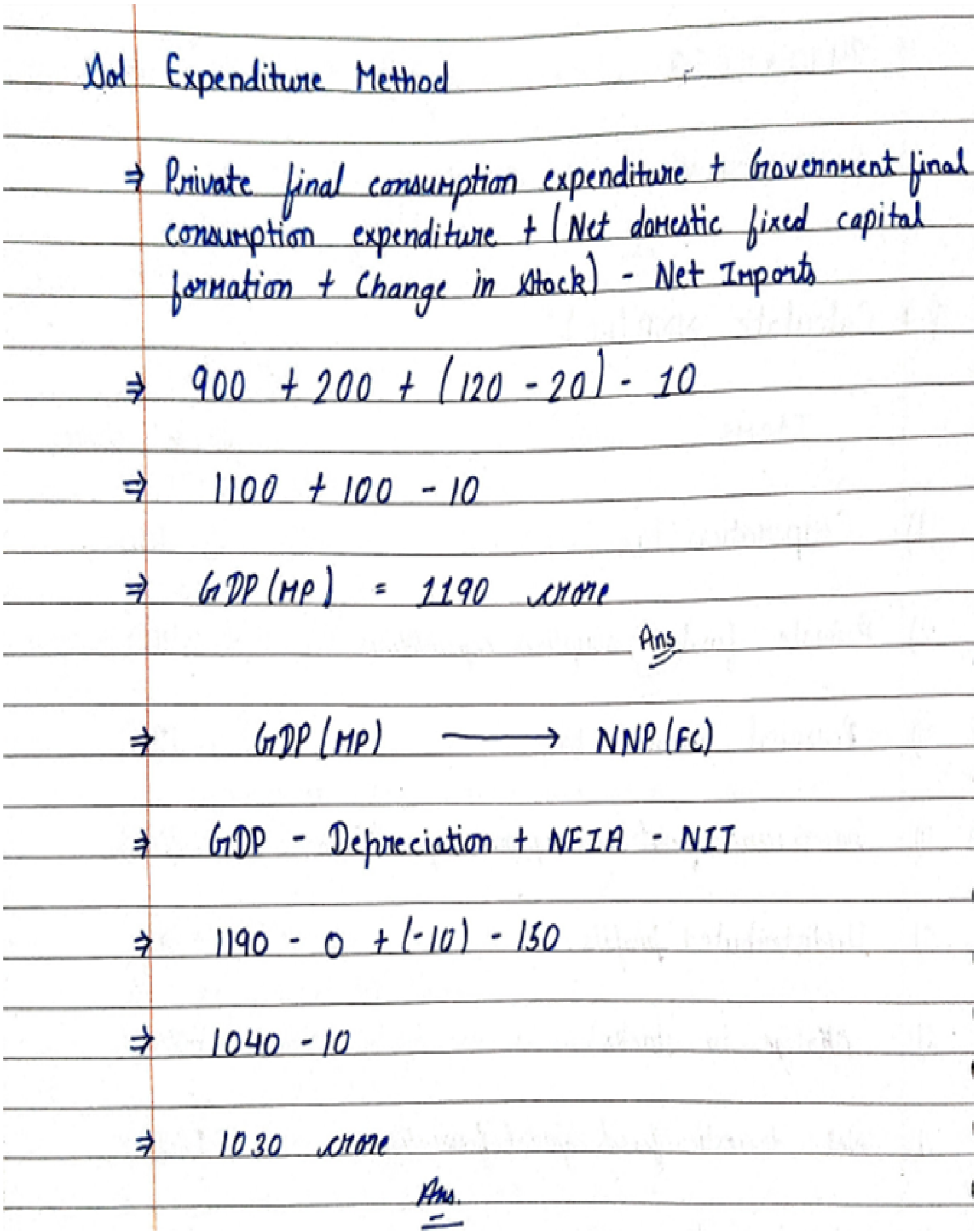

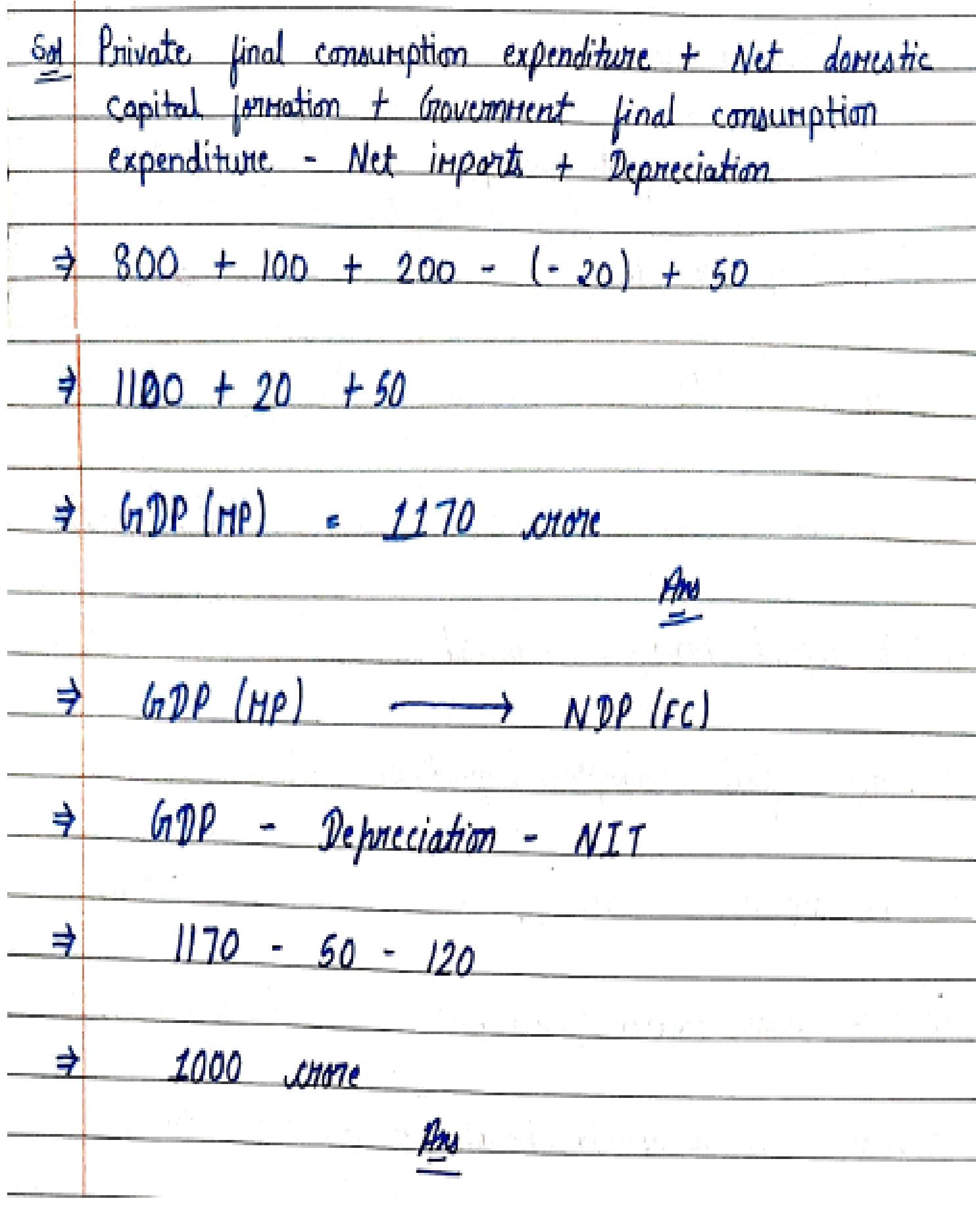

4. Calculate National Income

| Items | (₹ in crore) |

| 1. Corporation tax | 100 |

| 2. Private final consumption expenditure | 900 |

| 3. Personal income tax | 120 |

| 4. Government final consumption expenditure | 200 |

| 5. Undistributed profits | 50 |

| 6. Change in stocks | – 20 |

| 7. Net Domestic fixed capital formation | 120 |

| 8. Net Imports | 10 |

| 9. Net Indirect tax | 150 |

| 10. Net factor income from abroad | – 10 |

| 11. Private Incom | 1000 |

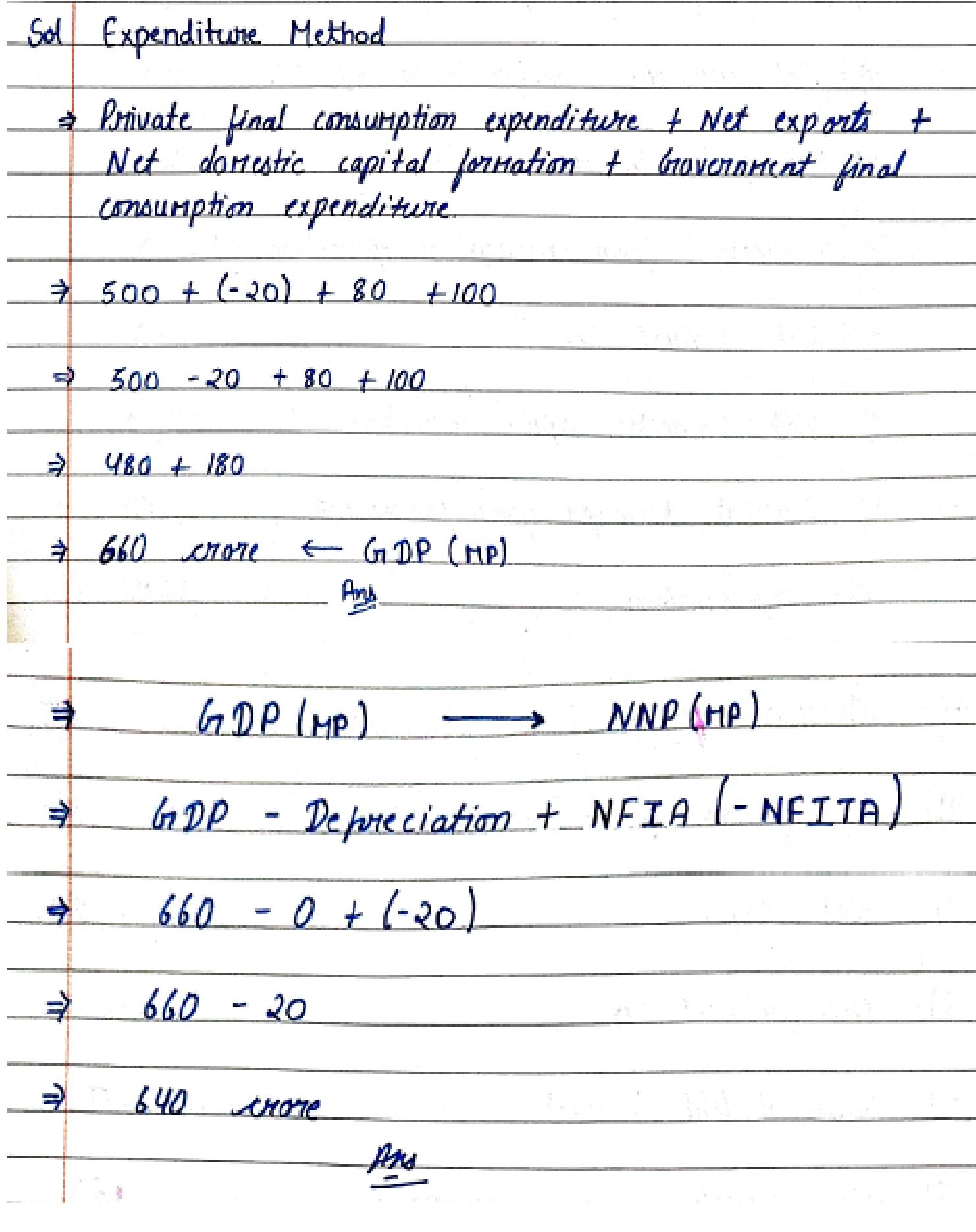

5. Calculate Net National Product at Market Price:

| Items | (₹ in crore) |

| 1. Net Current transfers to abroad | 10 |

| 2. Private final consumption expenditure | 500 |

| 3. Current transfers from government | 30 |

| 4. Net factor income to abroad | 20 |

| 5. Net exports | – 20 |

| 6. Net indirect tax | 120 |

| 7. National debt interest | 70 |

| 8. Net Domestic Capital formation | 80 |

| 9. Income accruing to government | 60 |

| 10. Government final consumption expenditure | 100 |

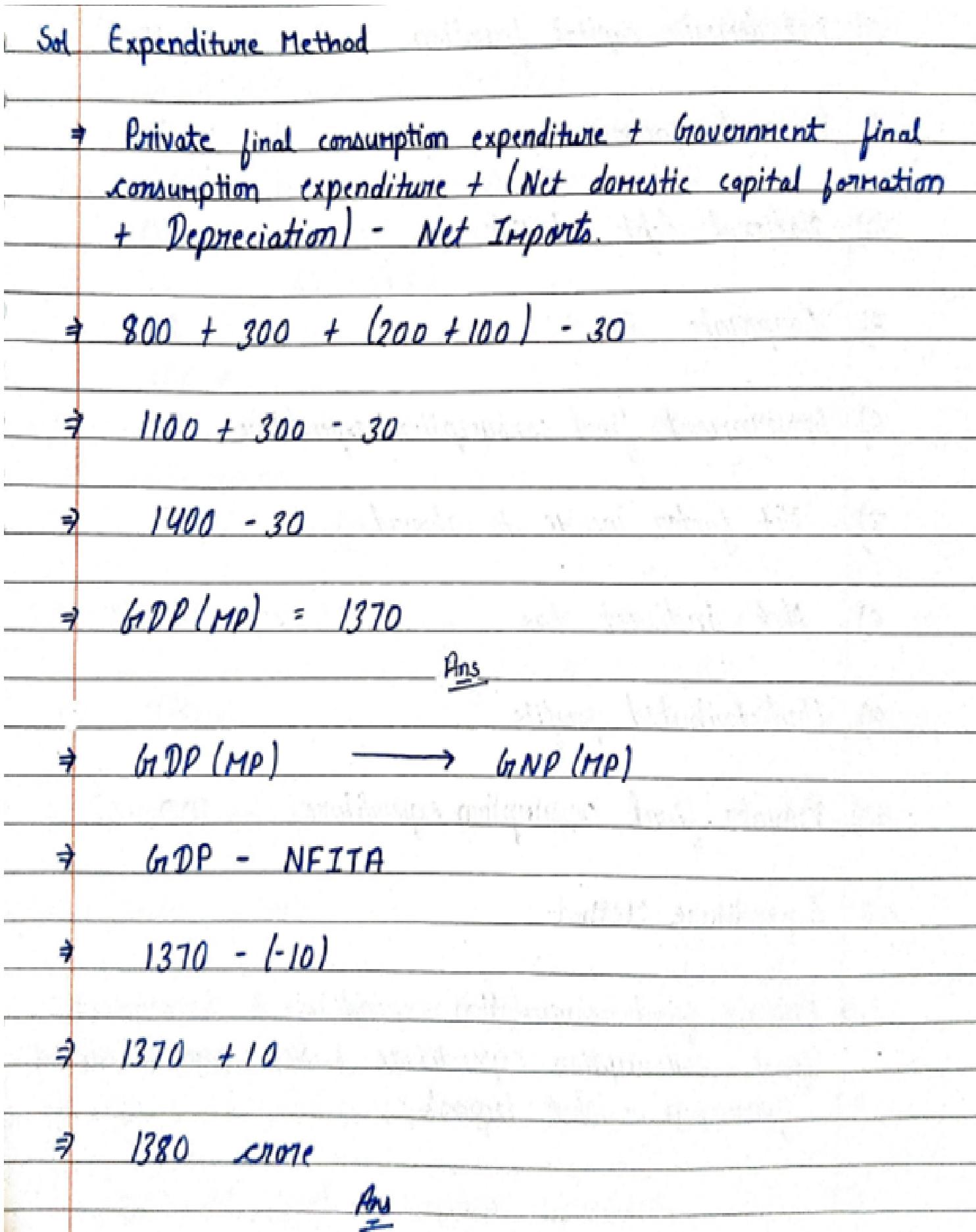

6. Find Gross National Product at Market Price:

| Items | (₹ in crore) |

| 1. Private final consumption expenditure | 800 |

| 2. Net Current transfers to abroad | 20 |

| 3. Net factor income to abroad | – 10 |

| 4. Government final consumption expenditure | 300 |

| 5. Net Indirect tax | 150 |

| 6. Net Domestic Capital Formation | 200 |

| 7. Current transfers from government | 40 |

| 8. Depreciation | 100 |

| 9. Net Imports | 30 |

| 10. Income accruing to government | 90 |

| 11. National debt interest | 50 |

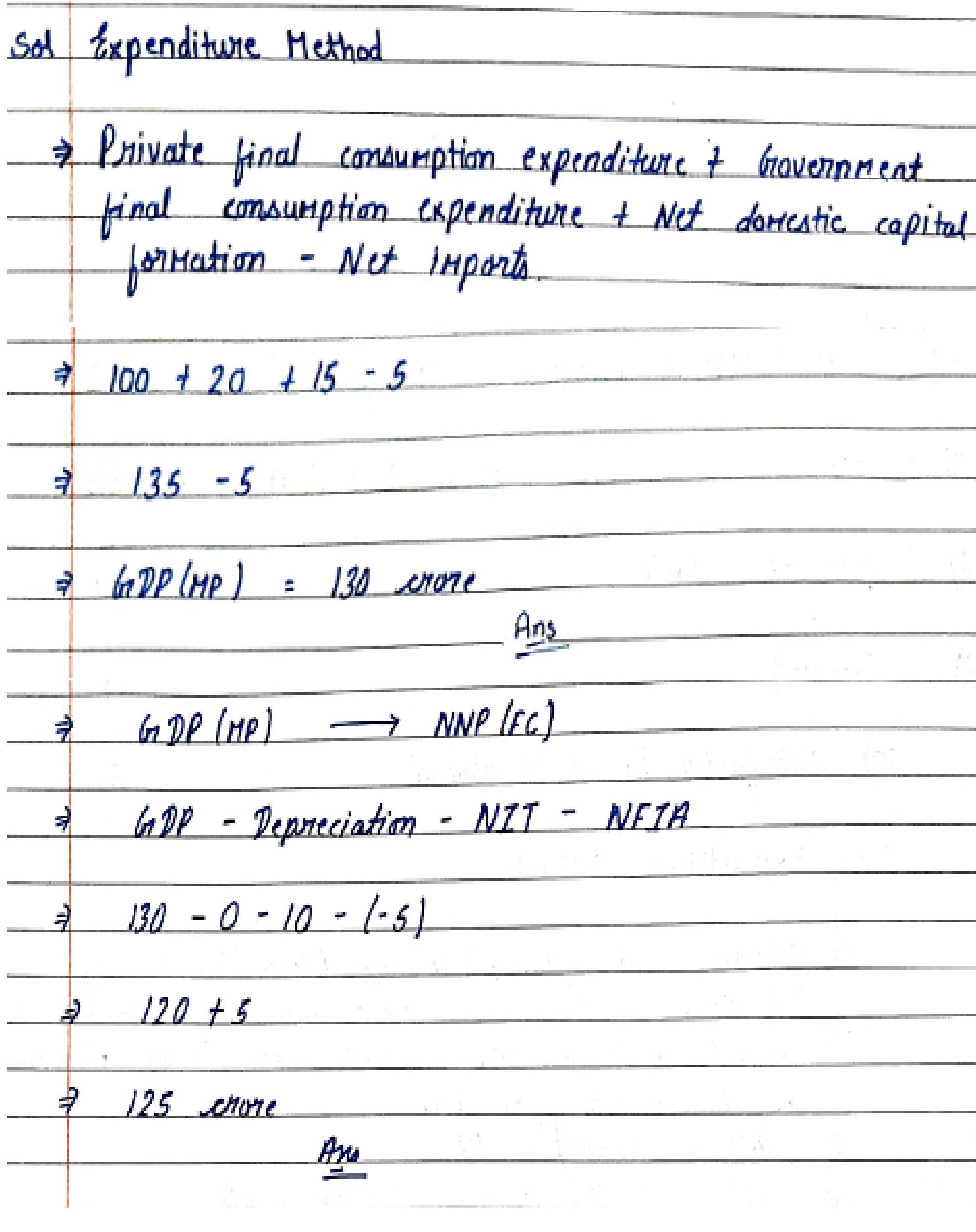

7. Calculate National Income

| Items | (₹ in crore) |

| 1. Net imports | 5 |

| 2. Net domestic capital formation | 15 |

| 3. Personal Income | 90 |

| 4. National debt interest | 10 |

| 5. Corporate tax | 25 |

| 6. Government final consumption expenditure | 20 |

| 7. Net factor income to abroad | – 5 |

| 8. Net indirect tax | 10 |

| 9. Undistributed profits | 0 |

| 10. Private final consumption expenditure | 100 |

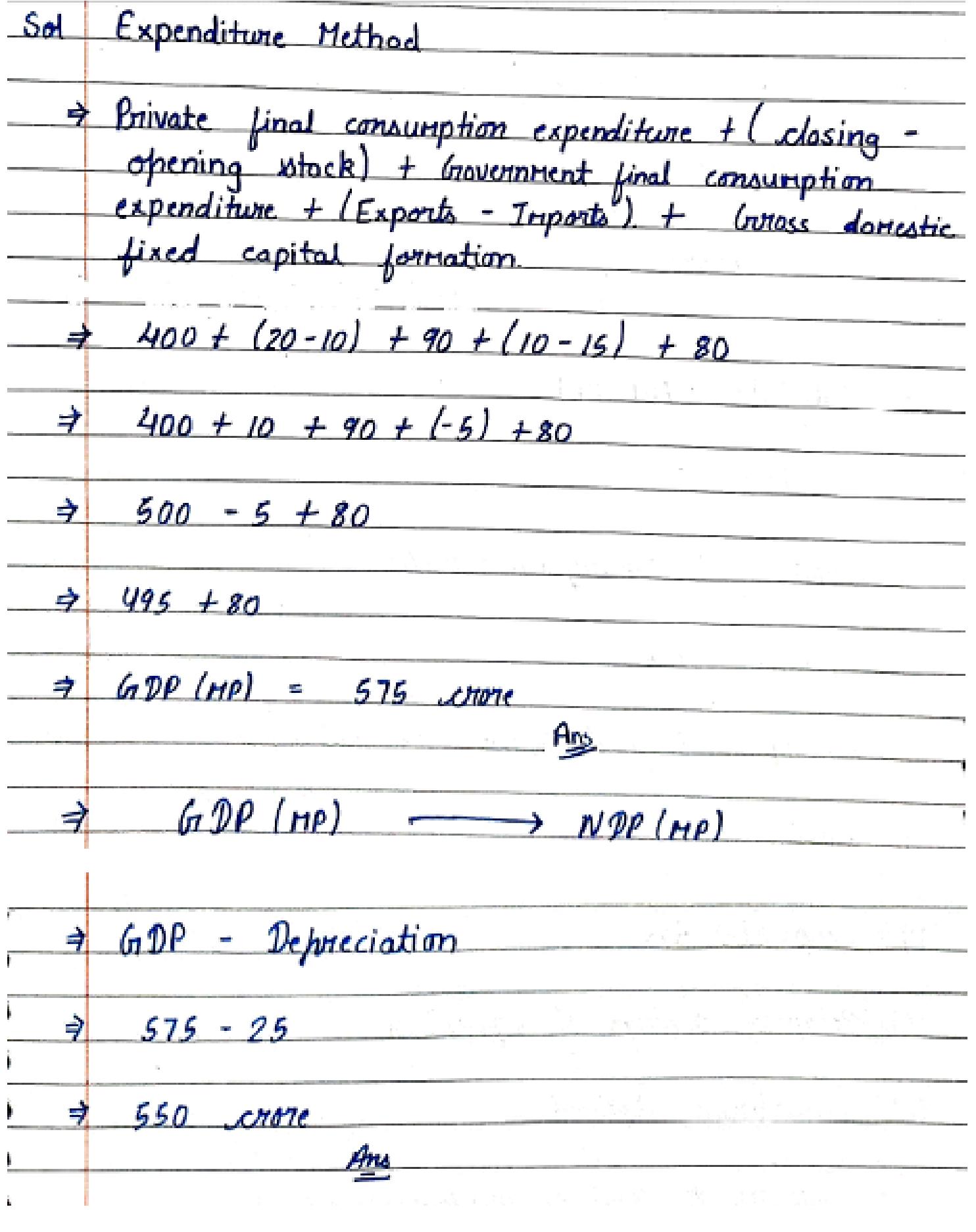

8. Calculate Net Domestic Product at Market Price.

| Items | (₹ in crore) |

| 1. Private Final consumption expenditure | 400 |

| 2. Opening stock | 10 |

| 3. Consumption of fixed capital | 25 |

| 4. Imports | 15 |

| 5. Government final consumption expenditure | 90 |

| 6. Net current transfers to rest of the world | 5 |

| 7. Gross domestic fixed capital formation | 80 |

| 8. Closing stock | 20 |

| 9. Exports | 10 |

| 10. Net factor income to abroad | – 5 |

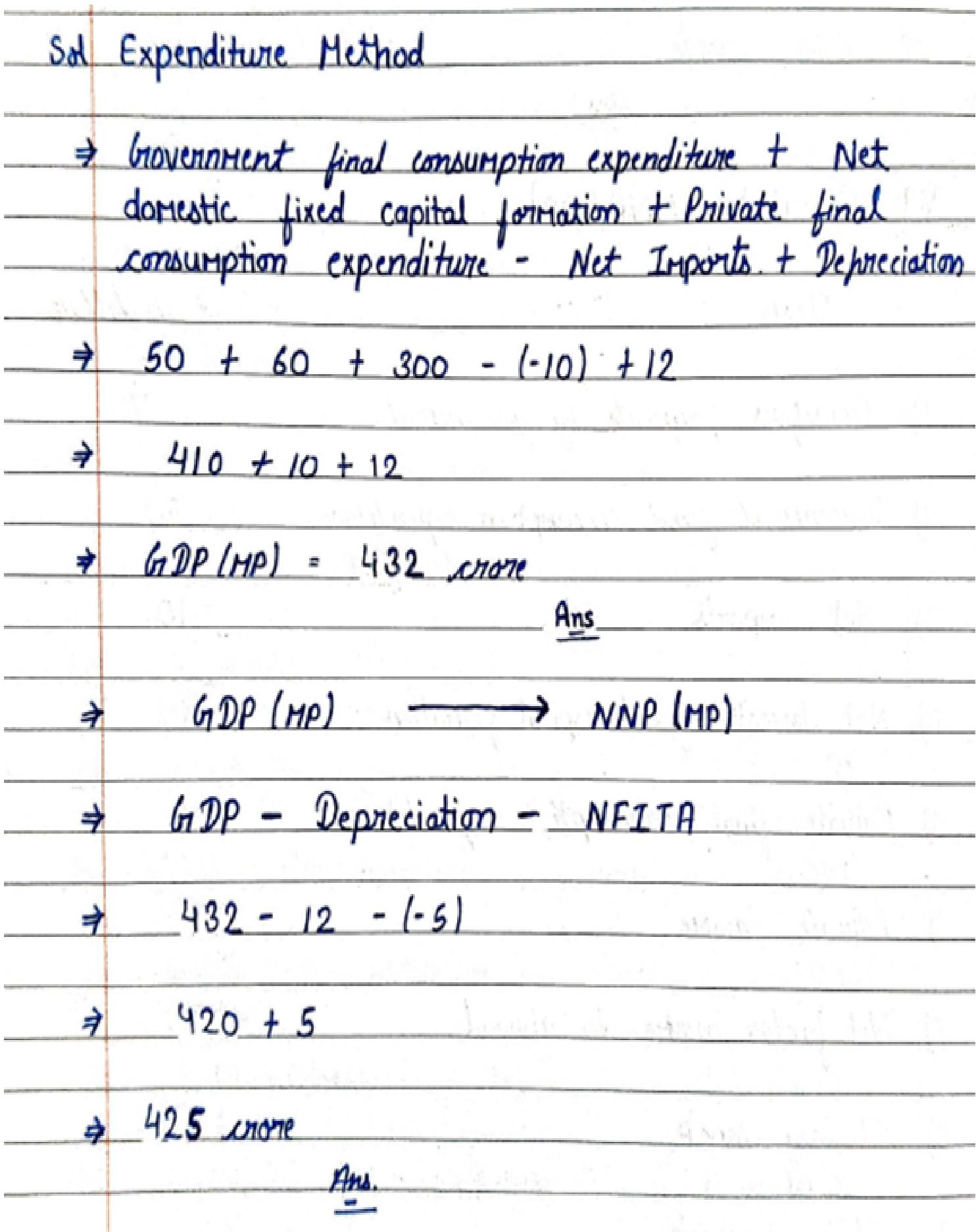

9. Calculate Net National Product at Market Price

| Items | (₹ in crore) |

| 1. Transfers Payments by government | 7 |

| 2. Government final consumption expenditure | 50 |

| 3. Net imports | – 10 |

| 4. Net domestic fixed capital formation | 60 |

| 5. Private final consumption expenditure | 300 |

| 6. Private Income | 280 |

| 7. Net factor income to abroad | – 5 |

| 8. Closing Stock | 8 |

| 9. Opening stock | 8 |

| 10. Depreciation | 12 |

| 11. Corporate tax | 60 |

| 12. Retained earnings of corporations | 20 |

10. Calculate Net Domestic Product at Factor Cost:

| Items | (₹ in crore) |

| 1. Net Current transfers to abroad | 15 |

| 2. Private final consumption expenditure | 800 |

| 3. Net imports | – 20 |

| 4. Net domestic capital formation | 100 |

| 5. Net factor income to abroad | 10 |

| 6. Depreciation | 50 |

| 7. Change in stocks | 17 |

| 8. Net indirect tax | 120 |

| 9. Government final consumption expenditure | 200 |

| 10. Exports | 30 |

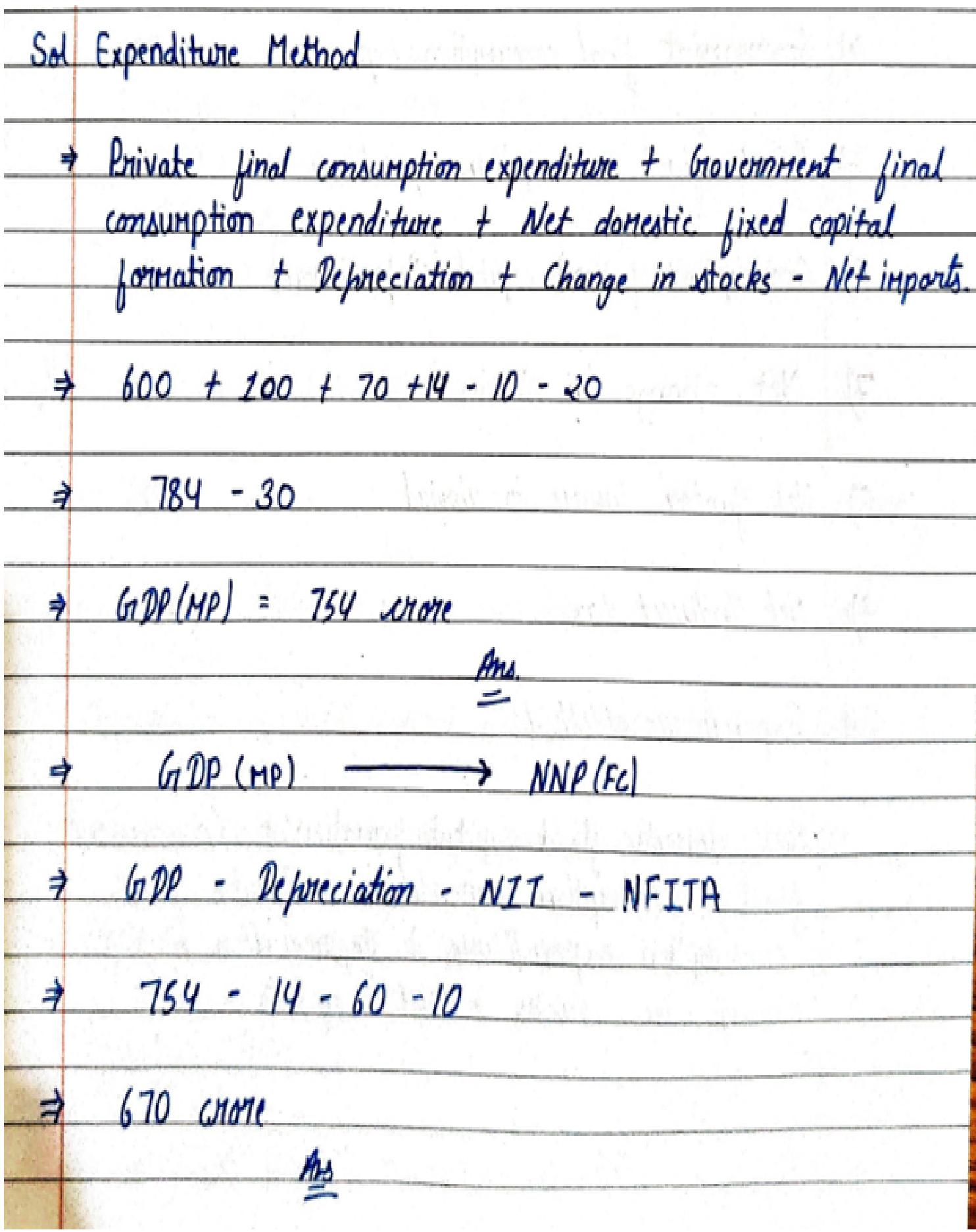

11. Calculate ‘National Income’.

| Items | (₹ in crore) |

| 1. Personal tax | 80 |

| 2. Private final consumption expenditure | 600 |

| 3. Undistributed profits | 30 |

| 4. Private Income | 650 |

| 5. Government final consumption expenditure | 100 |

| 6. Corporate tax | 50 |

| 7. Net Domestic fixed capital formation | 70 |

| 8. Net Indirect tax | 60 |

| 9. Depreciation | 14 |

| 10. Change in stocks | – 10 |

| 11. Net imports | 20 |

| 12. Net factor income to abroad | 10 |

12. Calculate ‘National Income’ from the following

| Items | (₹ in crore) |

| 1. Net Imports | 60 |

| 2. Net current transfers to abroad | – 10 |

| 3. Net domestic fixed capital formation | 300 |

| 4. Government final consumption expenditure | 200 |

| 5. Private final consumption expenditure | 700 |

| 6. Consumption of fixed capital | 70 |

| 7. Net change in stocks | 30 |

| 8. Net factor income to abroad | 20 |

| 9. Net indirect tax | 100 |

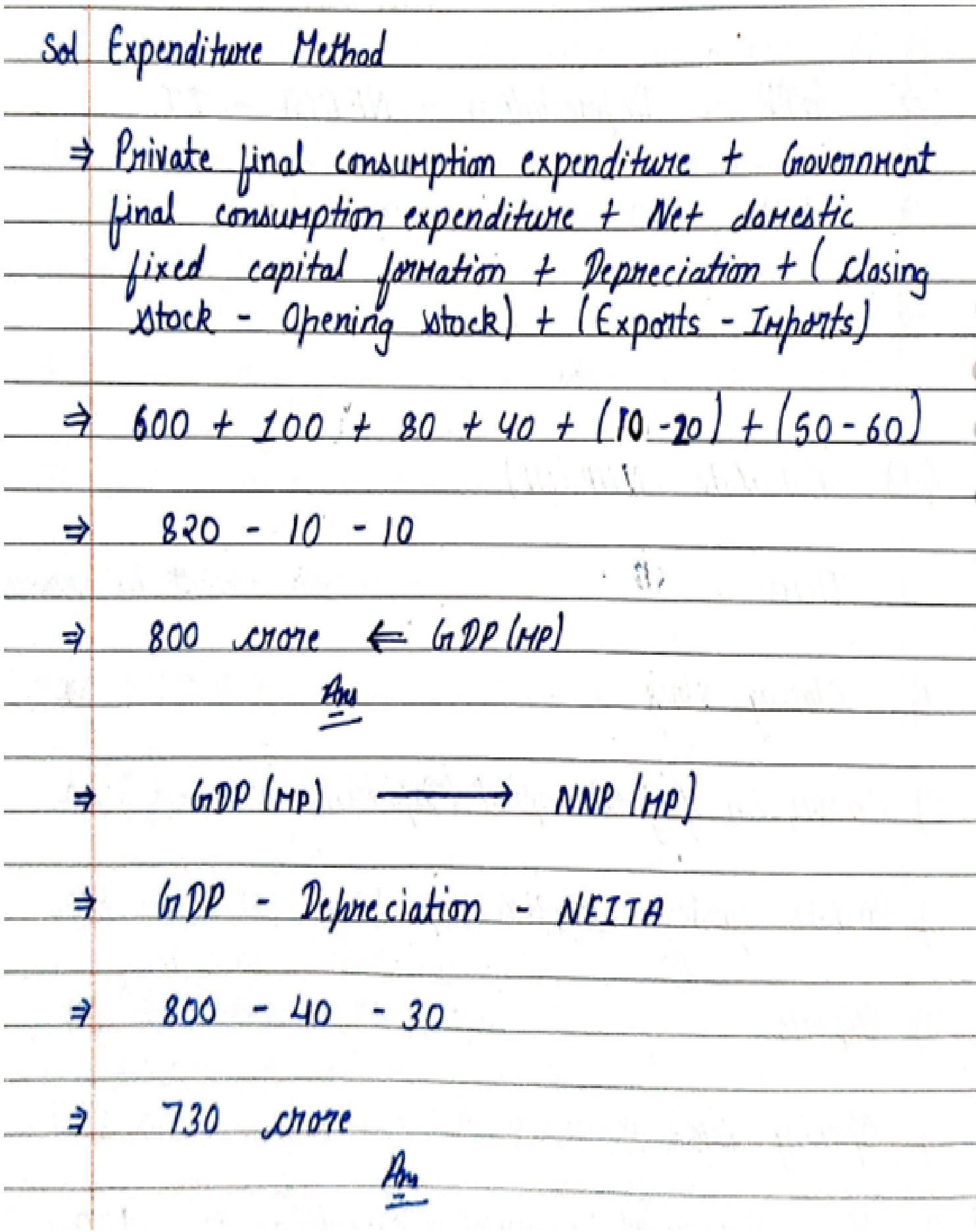

13. Calculate ‘Net National Product at Market Price’ from the following.

| Items | (₹ in crore) |

| 1. Closing stock | 10 |

| 2. Consumption of fixed capital | 40 |

| 3. Private final consumption expenditure | 600 |

| 4. Exports | 50 |

| 5. Opening stock | 20 |

| 6. Government final consumption expenditure | 100 |

| 7. Imports | 60 |

| 8. Net domestic fixed capital formation | 80 |

| 9. Net current transfers to abroa | – 10 |

| 10. Net factor income to abroad | 30 |

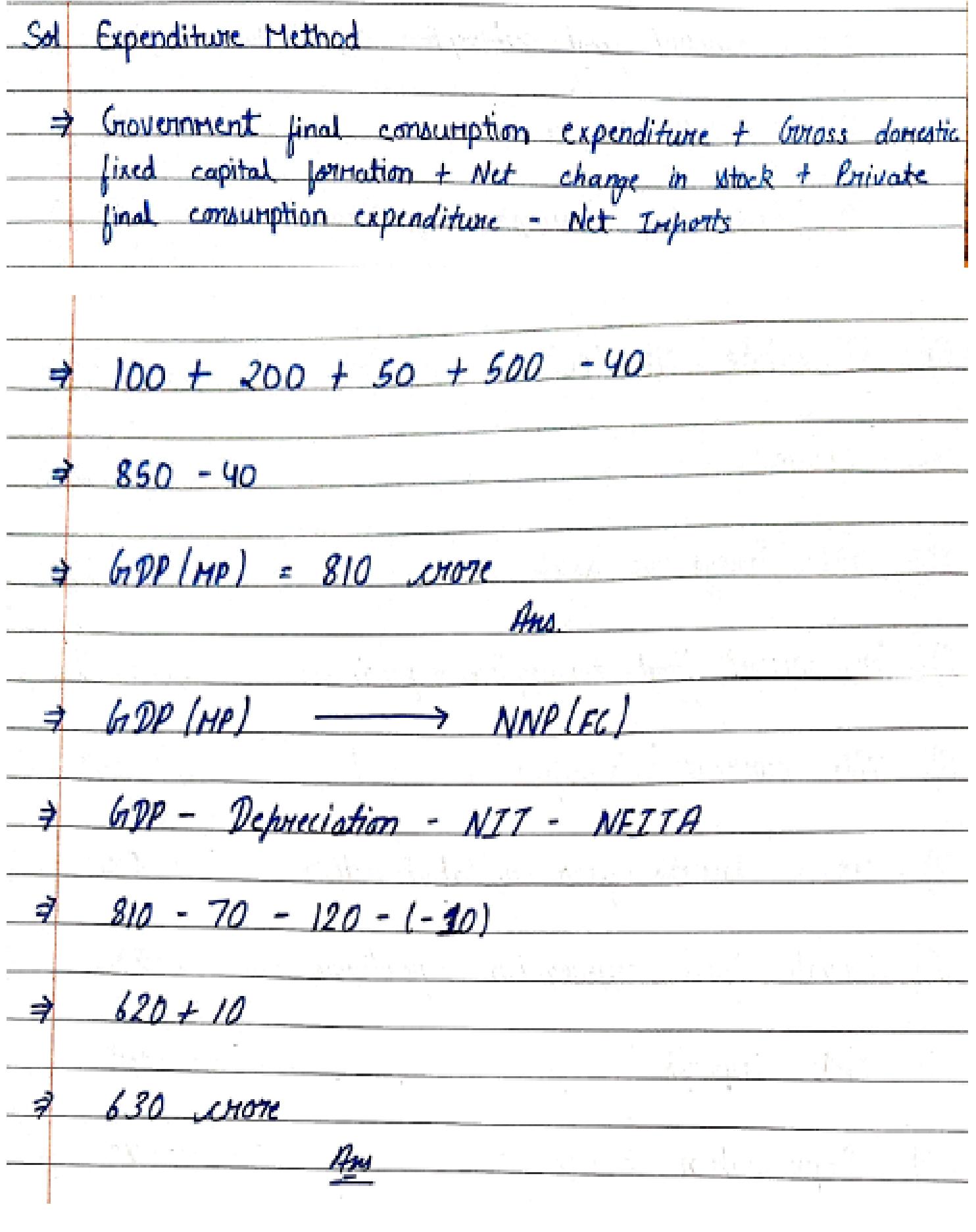

14. Calculate National Income from the following.

| Items | (₹ in crore) |

| 1. Net change in stocks | 50 |

| 2. Government final consumption expenditure | 100 |

| 3. Net current transfers to abroad | 30 |

| 4. Gross domestic fixed capital formation | 200 |

| 5. Private final consumption expenditure | 500 |

| 6. Net imports | 40 |

| 7. Depreciation | 70 |

| 8. Net factor income to abroad | – 10 |

| 9. Net Indirect tax | 120 |

| 10. Net capital transfers to abroad | 25 |

15. Calculate ‘Net Domestic Product at Factor Cost’ from the following:-

| Items | (₹ in crore) |

| 1. Net Current transfers to abroad | 5 |

| 2. Government final consumption expenditure | 100 |

| 3. Net indirect tax | 80 |

| 4. Private final consumption expenditure | 300 |

| 5. Consumption of fixed capital | 20 |

| 6. Gross domestic fixed capital formation | 50 |

| 7. Net imports | – 10 |

| 8. Closing stock | 25 |

| 9. Opening stock | 25 |

| 10. Net factor income to abroad | 10 |

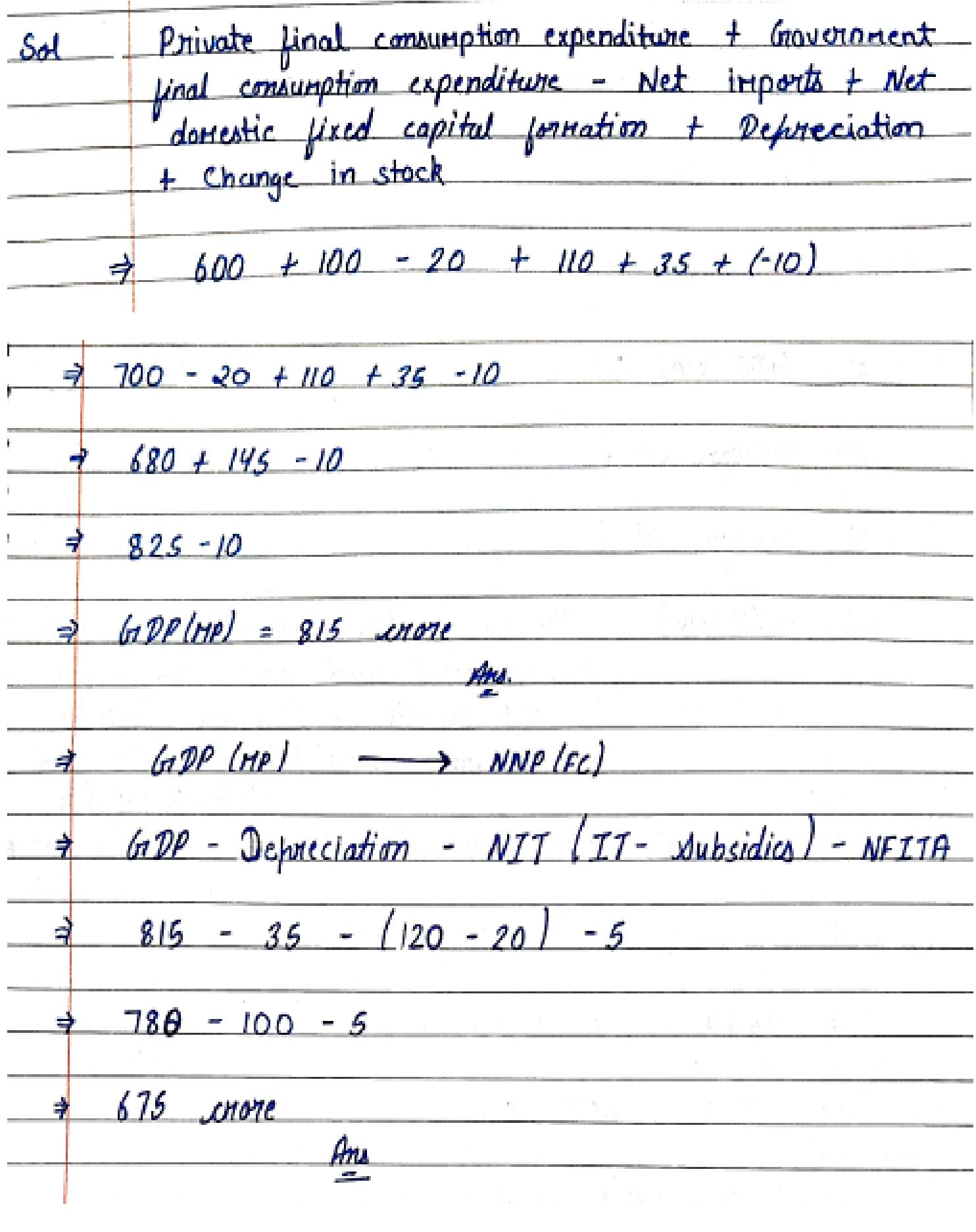

16. Calculate National Income from the following:

| Items | (₹ in crore) |

| 1. Net current transfers to abroad | – 15 |

| 2. Private final consumption expenditure | 600 |

| 3. Subsidies | 20 |

| 4. Government final consumption expenditure | 100 |

| 5. Indirect tax | 120 |

| 6. Net imports | 20 |

| 7. Consumption of fixed capital | 35 |

| 8. Net change in stocks | – 10 |

| 9. Net factor income to abroad | 5 |

| 10. Net domestic capital formation | 110 |

17. Calculate Gross Fixed Capital Formation from the following data:-

| Items | (₹ in crore) |

| 1. Private final consumption expenditure | 1000 |

| 2. Government final consumption expenditure | 500 |

| 3. Net Exports | – 50 |

| 4. Net Factor income from abroad | 20 |

| 5. Gross Domestic product at market price | 2500 |

| 6. Opening Stock | 300 |

| 7. Closing Stock | 200 |

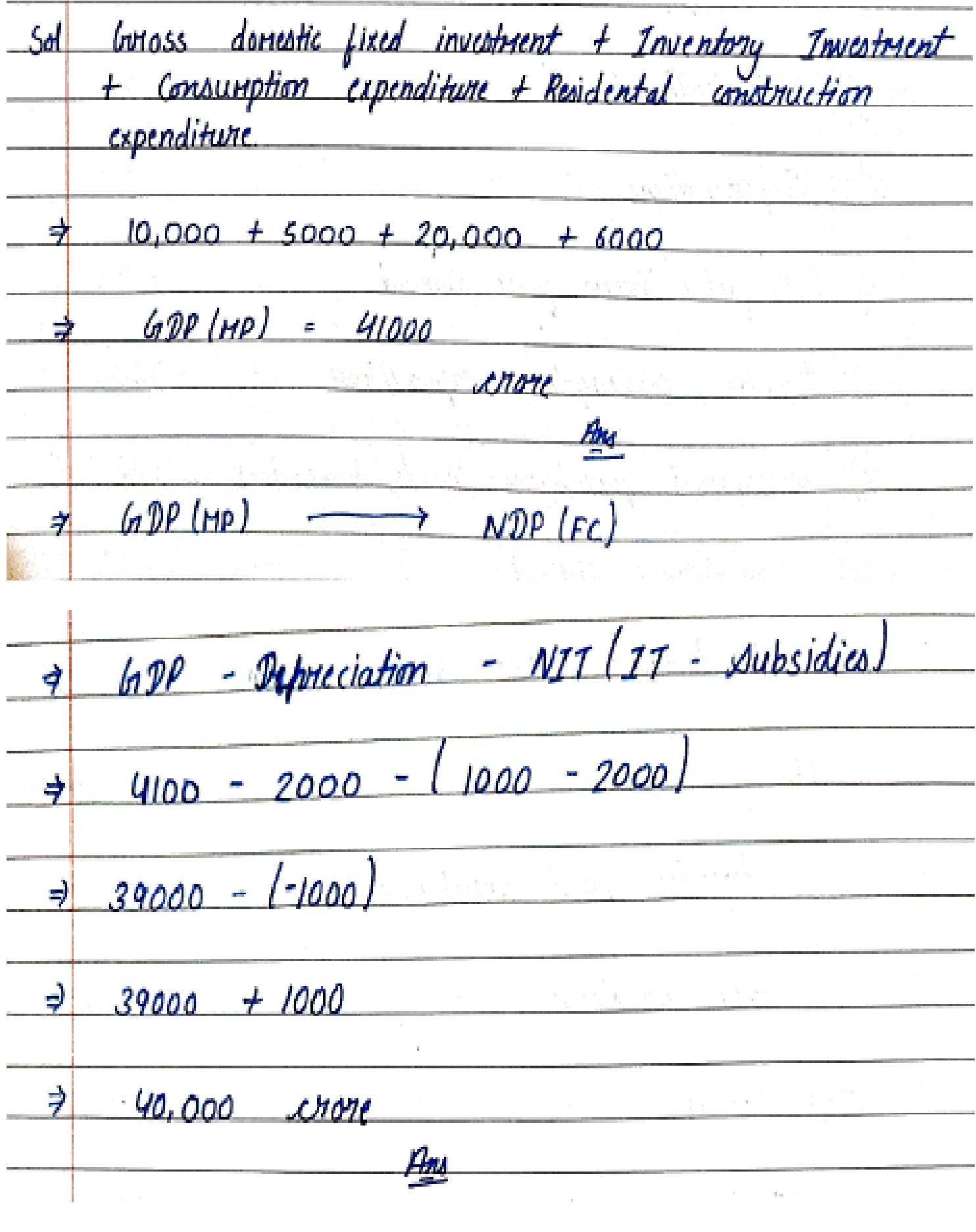

18. Find NDP at FC from the following data.

| Items | (₹ in crore) |

| 1. Gross Domestic fixed investment | 10000 |

| 2. Inventory investment | 5000 |

| 3. Depreciation | 2000 |

| 4. Indirect taxes | 1000 |

| 5. Subsidies | 2000 |

| 6. Consumption Expenditure | 20000 |

| 7. Residential Construction Investment | 6000 |

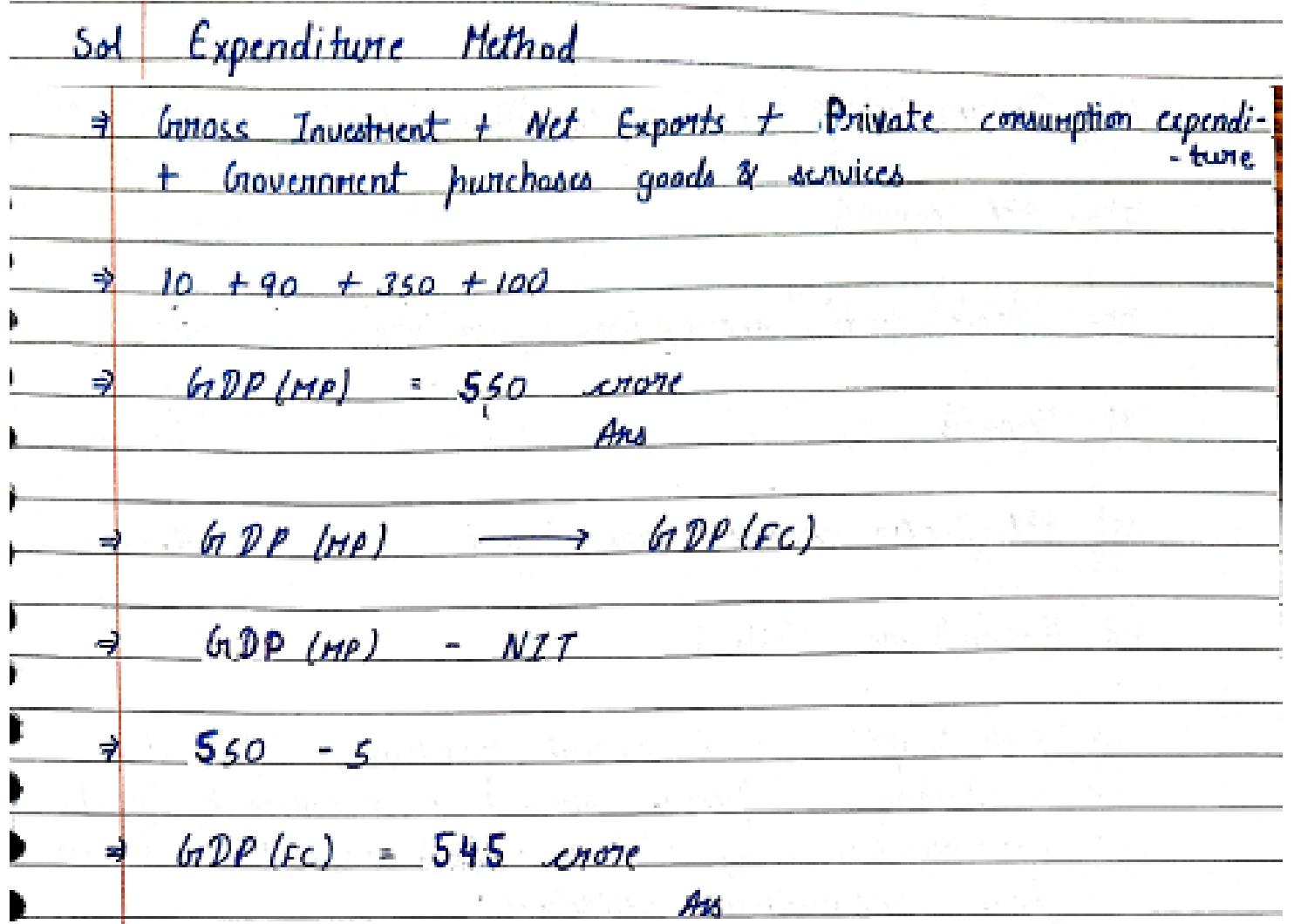

19. From the following data, calculate the GDP at both (a) Market price, and (b) Factor Cost.

| Items | (₹ in crore) |

| 1. Gross investment | 90 |

| 2. Net exports | 10 |

| 3. Net indirect taxes | 5 |

| 4. Depreciation | 15 |

| 5. Net factor income from abroad | – 5 |

| 6. Private consumption expenditure | 350 |

| 7 Government purchases of goods and services | 100 |

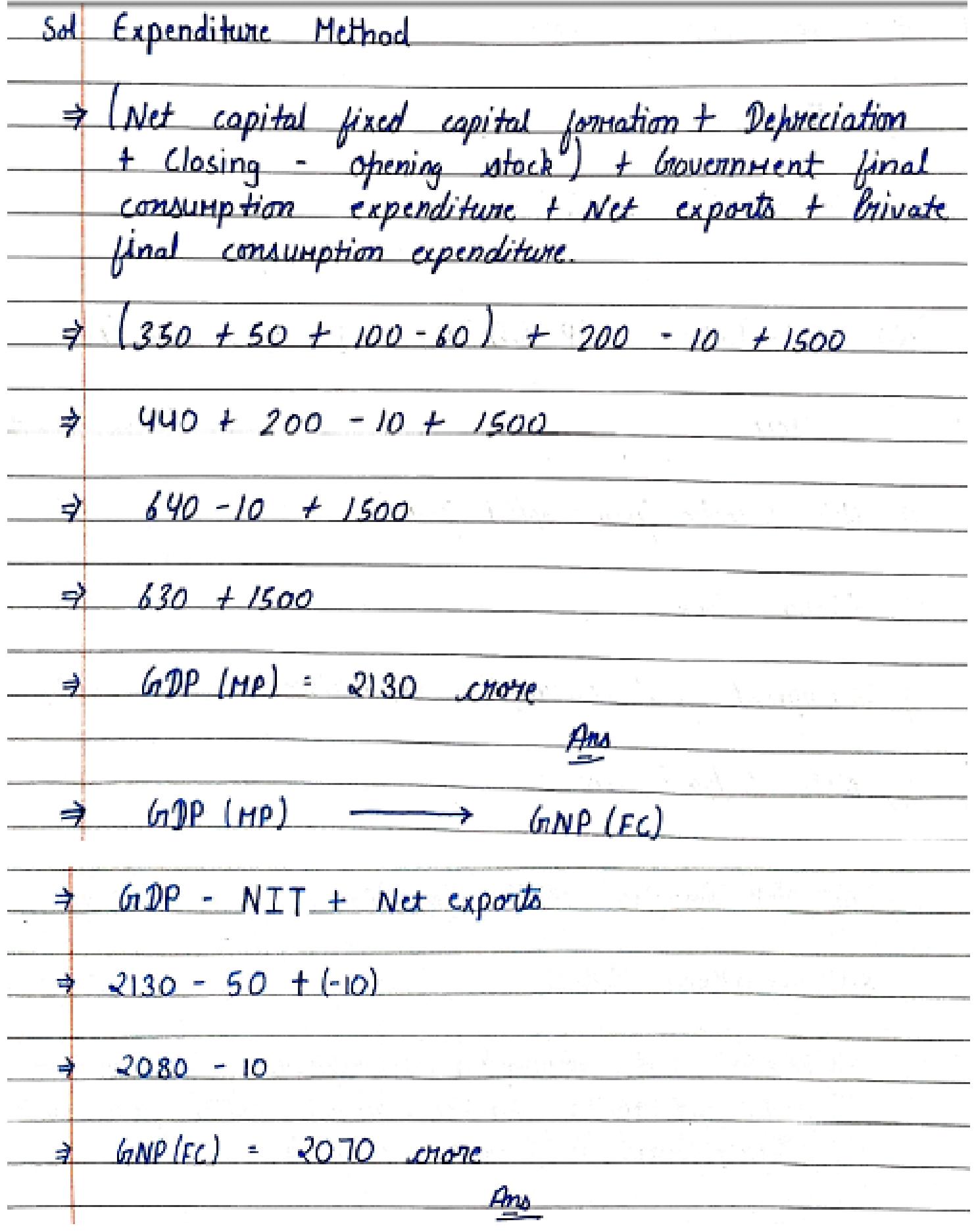

20. Calculate the gross national product at factor cost from the following data:-

| Items | (₹ in crore) |

| 1. Net Domestic Fixed capital formation | 350 |

| 2. Closing Stock | 100 |

| 3. Government final consumption expenditure | 200 |

| 4. Net indirect tax | 50 |

| 5. Opening stock | 60 |

| 6. Consumption of fixed capital | 50 |

| 7. Net exports | – 10 |

| 8. Private final consumption expenditure | 1500 |

| 9. Imports | 20 |

| 10. Net factor income from abroad | – 10 |

21. Calculate Gross Domestic Product at market price from the following data:-

| Items | (₹ in crore) |

| 1. Consumption of fixed capital | 50 |

| 2. Closing stock | 40 |

| 3. Private final consumption expenditure | 500 |

| 4. Opening stock | 60 |

| 5. Net factor income from abroad | – 35 |

| 6. Exports | 25 |

| 7. Government final consumption expenditure | 200 |

| 8. Imports | 40 |

| 9. Net indirect tax | 100 |

| 10. net domestic capital formation | 300 |

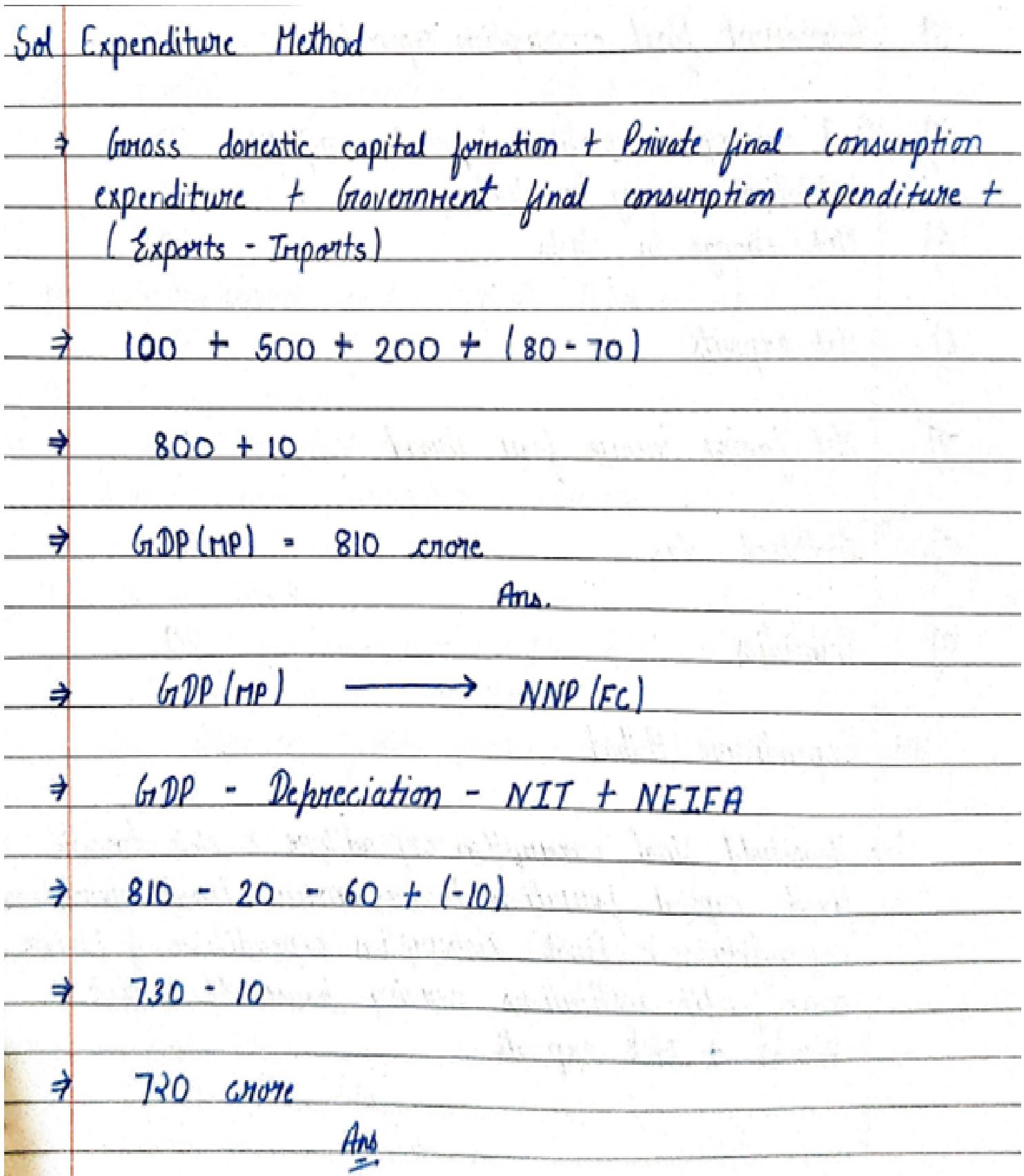

22. Calculate national income from the following data:-

| Items | (₹ in crore) |

| 1. Gross Domestic capital formation | 100 |

| 2. Net change in stocks | 10 |

| 3. Consumption of fixed capital | 20 |

| 4. Private final consumption expenditure | 500 |

| 5. Government final consumption expenditure | 200 |

| 6. Exports | 80 |

| 7. Imports | 70 |

| 8. Net indirect tax | 60 |

| 9. Net factor income received from abroad | – 10 |

23.

- Calculate NNP at MP from the following data:-

| Items | (₹ in crore) |

| 1. Household final consumption expenditure | 1000 |

| 2. Net domestic fixed capital formation | 100 |

| 3. Government final consumption expenditure | 200 |

| 4. Final consumption expenditure of private non-profit institutions serving households | 50 |

| 5. Net change in stocks | 40 |

| 6. Net exports | – 20 |

| 7. Net factor income from abroad | 10 |

| 8. Indirect tax | 70 |

| 9. Subsidies | 20 |

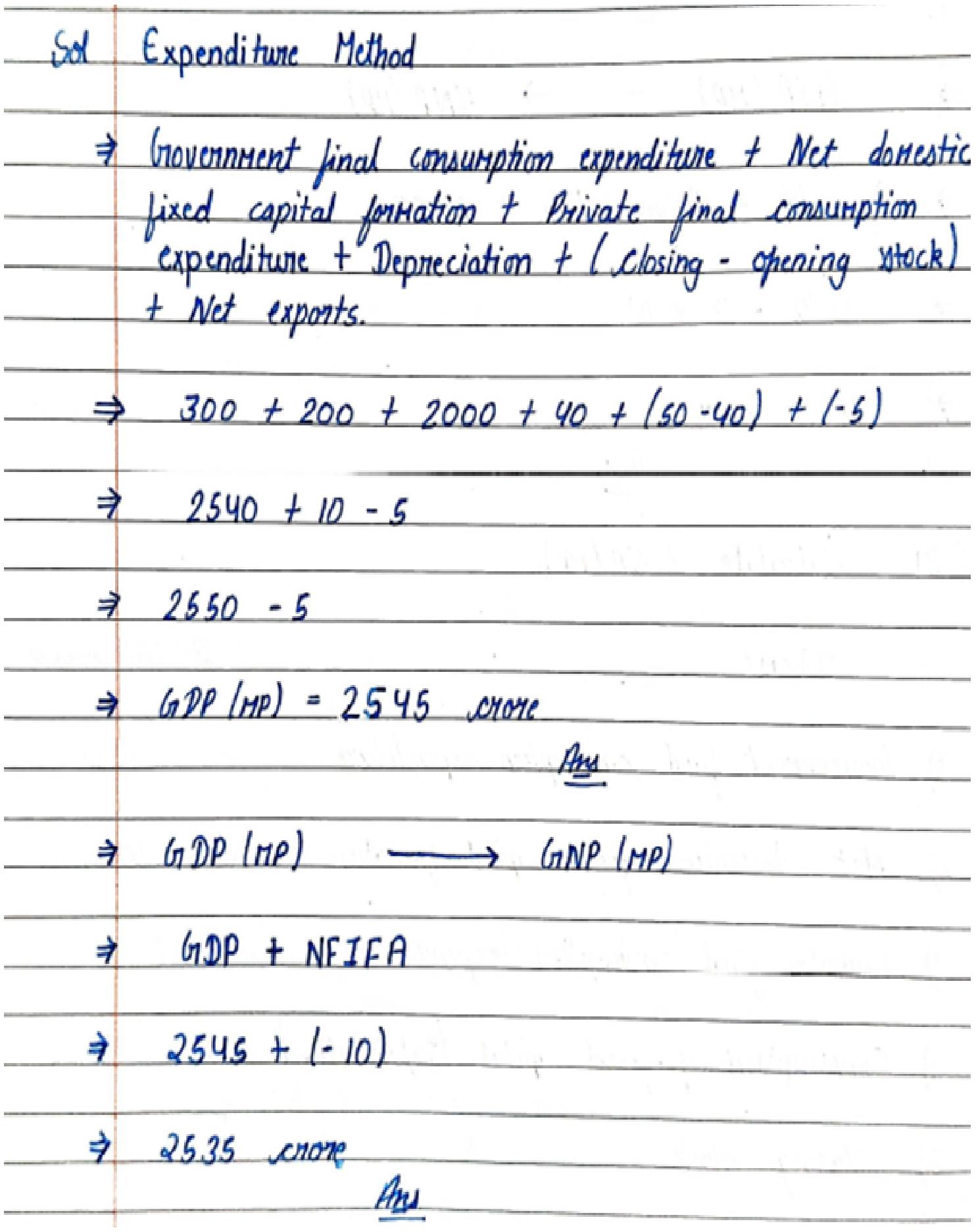

24. Calculate GNP at MP from the following data:-

| Items | (₹ in crore) |

| 1. Government final consumption expenditure | 300 |

| 2. Net domestic fixed capital formation | 200 |

| 3. Private final consumption expenditure | 2000 |

| 4. Consumption of fixed capital | 40 |

| 5. Closing stock | 50 |

| 6. Opening stock | 40 |

| 7. Net exports | – 5 |

| 8. Net indirect tax | 30 |

| 9. Net factor income from abroad | – 10 |

25. Calculate NDP at factor cost:-

| Items | (₹ in crore) |

| 1. Net domestic fixed capital formation | 70 |

| 2. Private final consumption expenditure | 300 |

| 3. Exports | 20 |

| 4. Consumption of fixed capital | 10 |

| 5. Government final consumption expenditure | 100 |

| 6. Closing stock | 15 |

| 7. Imports | 30 |

| 8. Opening stock | 5 |

| 9. Net indirect tax | 80 |

| 10. Net factor income to abroad | – 10 |

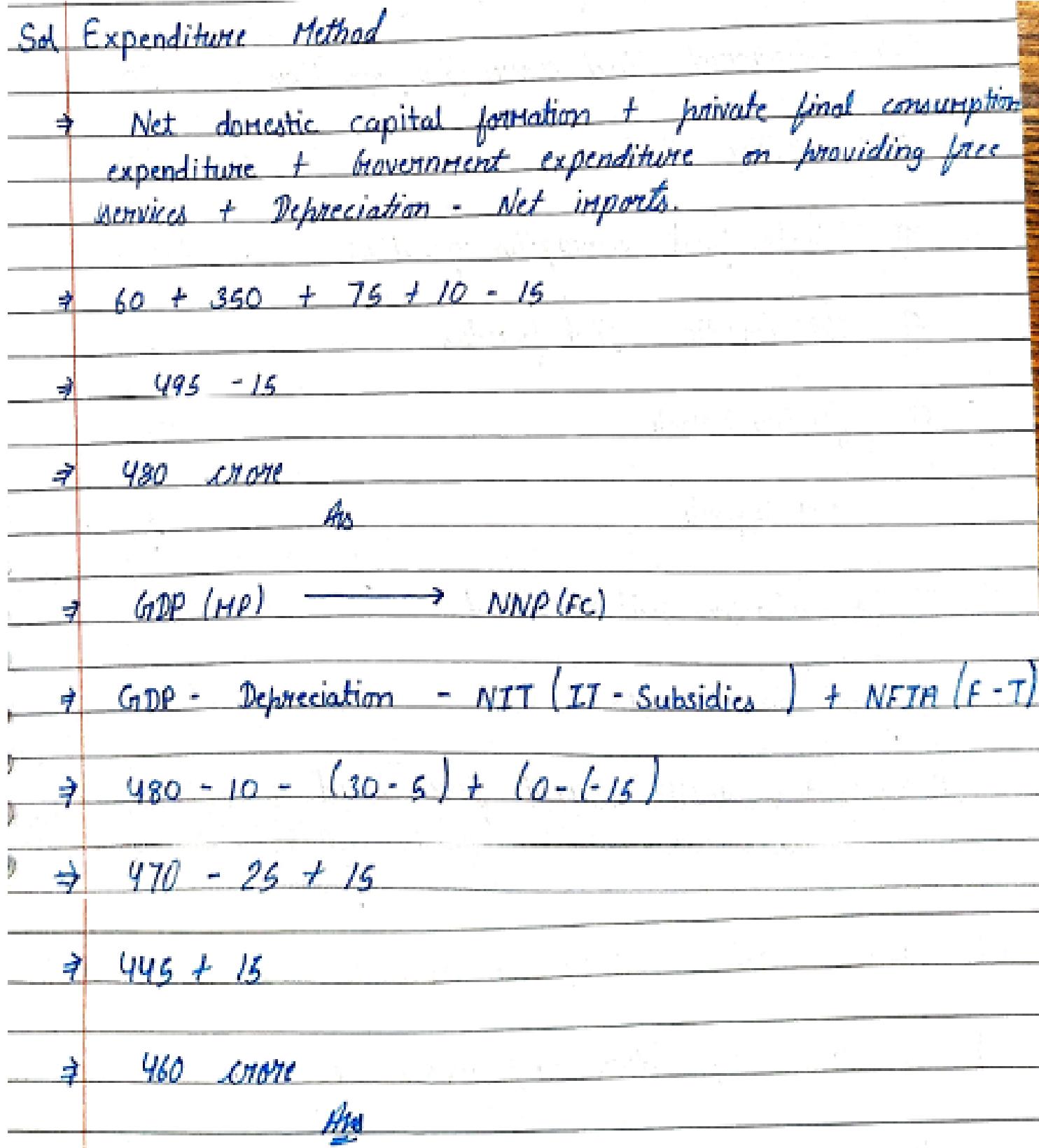

26. Calculate National Income:-

| Items | (₹ in crore) |

| 1. Net imports | 15 |

| 2. Net current transfers from abroad | 10 |

| 3. Goods and services tax (GST) | 30 |

| 4. Net change in stocks | 5 |

| 5. Net domestic capital formation | 60 |

| 6. Private final consumption expenditure | 350 |

| 7. Government expenditure on providing free services | 75 |

| 8. Depreciation | 10 |

| 9. Net factor income to abroad | – 15 |

| 10. Subsidies | 5 |

27. Calculate NNP at MP:-

| Items | (₹ in crore) |

| 1. Gross domestic fixed capital formation | 80 |

| 2. Government final consumption expenditure | 150 |

| 3. Closing stock | 20 |

| 4. Private final consumption expenditure | 500 |

| 5. Net domestic capital formation | 70 |

| 6. Opening stock | 20 |

| 7. Net imports | – 30 |

| 8. Factor income paid to abroad | 15 |

| 9. Net indirect tax | 40 |

| 10. Factor income received from abroad | 10 |

28. Calculate the GDP at MP by using the expenditure method.

| S. No. | Items | Amount (in crores) |

| (i) | Private final consumption expenditure | 1200 |

| (ii) | Government final consumption expenditure | 2400 |

| (iii) | Gross domestic fixed capital formation | 3500 |

| (iv) | Change in stock | 600 |

| (v) | Exports-Imports | 700 |

29. Calculate the GDP at MP by using the expenditure method.

| S. No. | Items | Amount Rs. (in crores) |

| (i) | Total final consumption expenditure | 1000 |

| (ii) | Gross domestic fixed investment | 2000 |

| (iii) | Closing stock | 5000 |

| (iv) | Opening stock | 4000 |

| (v) | Net imports | 1000 |

30. Calculate the GDP at MP by using the expenditure method.

| S. No. | Items | Amount Rs. (in crores) |

| (i) | Private final consumption expenditure | 2400 |

| (ii) | Government final consumption expenditure | 2040 |

| (iii) | Gross business fixed investment | 4200 |

| (iv) | Gross public investment | 240 |

| (v) | Gross residential construction | 400 |

| (vi) | Change in inventory | 200 |

| (vi) | Net exports | 420 |

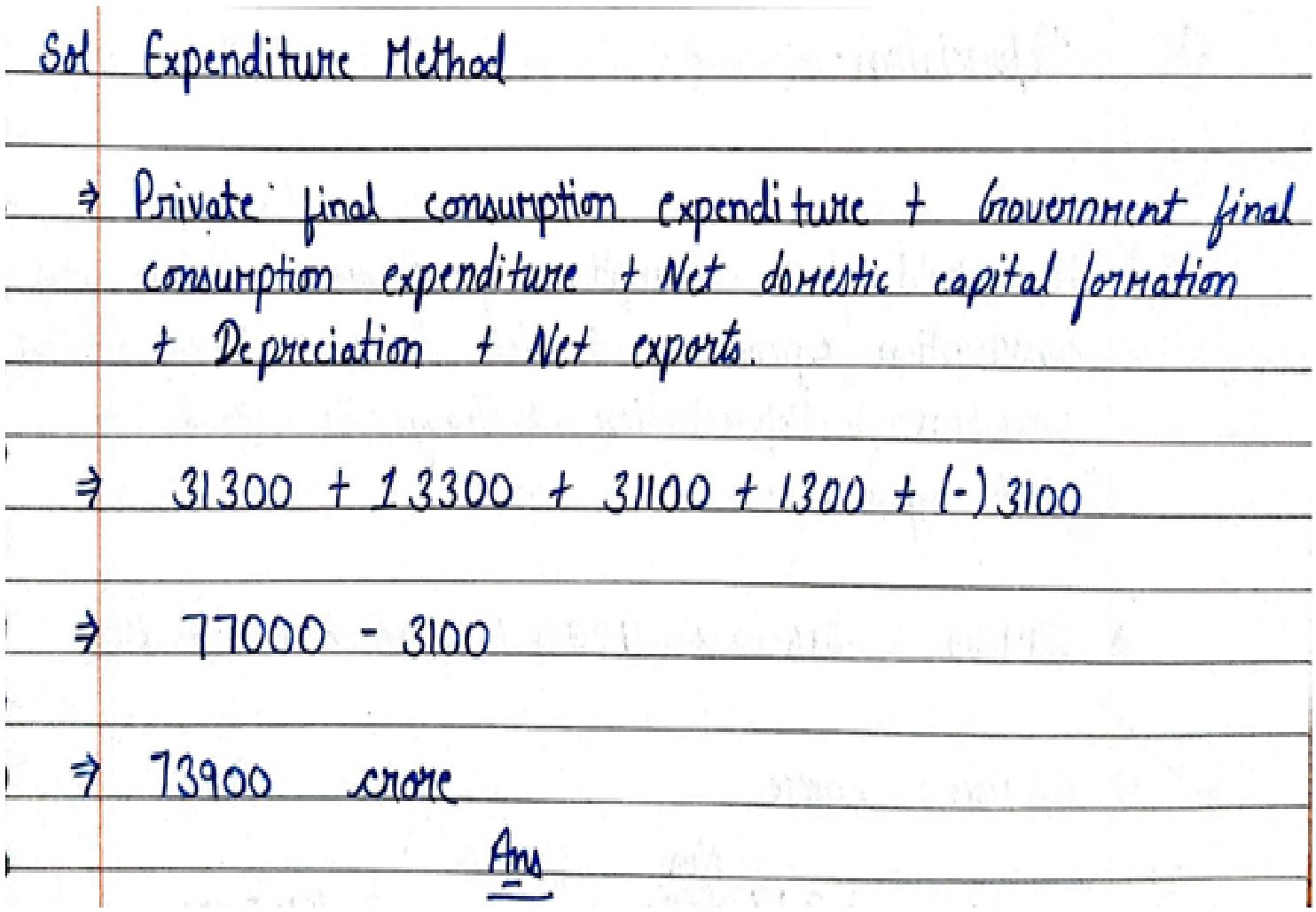

31. Calculate the GDP at MP by using the expenditure method.

| S. No. | Items | Amount Rs. (in crores) |

| (i) | Private final consumption expenditure | 31300 |

| (ii) | Government final consumption expenditure | 13300 |

| (iii) | Net domestic capital formation | 31100 |

| (iv) | Depreciation | 1300 |

| (v) | Net exports | (-)3100 |

32. Calculate the GDP at MP by using the expenditure method.

| S. No. | Items | Amount Rs. (in crores) |

| (i) | Household final consumption expenditure | 21400 |

| (ii) | Public final consumption expenditure | 21600 |

| (iii) | Net domestic fixed capital formation | 11200 |

| (iv) | Change in stock | 1100 |

| (v) | Net imports | 3100 |

| (vi) | Depreciation | 1200 |

33. Calculate the GDP at MP by using the expenditure method.

| S. No. | Items | Amount Rs. (in crores) |

| (i) | Household final consumption expenditure | 1400 |

| (ii) | Public final consumption expenditure | 1600 |

| (iii) | Net domestic fixed capital formation | 1200 |

| (iv) | Increase in stock | 800 |

| (v) | Net imports | (-)300 |

| (vi) | Consumption of fixed capital | 200 |

Also download – Class 12 Income Method Solutions

Why Use CHK Students’ Solutions?

-

Step-by-step approach with formulas.

-

Accurate and exam-focused answers.

-

Easy explanations for quick revision.

-

Prepared by toppers and subject experts.

Conclusion

The Expenditure Method is a scoring topic in Class 12 Economics. With the CHK Student’s solutions, you can easily understand concepts, avoid common mistakes, and perform well in board exams.

for more information contact us –

Ph. No. – +91-6367885579

WhatsApp – Click to chat

facebook – @commercehubkota

Instagram – @comerc_classes

Youtube – @commercehubkota

Telegram – @comerc.in