National Income and Related Aggregates Solutions | Class 12 Macroeconomics | Prepared by CHK Students

Understanding National Income and Related Aggregates is one of the most crucial parts of Class 12 Macroeconomics. This topic not only forms a major portion of the CBSE Economics syllabus but also helps students build a strong foundation for higher studies in commerce and economics, our CHK Student Keshav Khandelwal has carefully prepared these step-by-step solutions for the Income Method.

What You’ll Learn in This Chapter

The chapter deals with concepts that help measure the economic performance of a country. Here are some of the key topics covered:

Basic Concepts of Macroeconomics

- Domestic Territory, Normal Residents

- Factor Income & Transfer Income

National Income Aggregates

- GDP, GNP, NDP, NNP (at Market Price and Factor Cost)

-

Personal Income, Disposable Income, Private Income, National Disposable Income

Circular Flow of Income

- Two-sector model (Households & Firms)

-

Real and Money Flow

Methods of Calculating National Income

- Income Method

- Expenditure Method

- Value Added Method

Precautions While Calculating National Income

Why Choose CHK Student’s Solutions?

Our solutions are designed to be:

-

Clear and Simple: Step-by-step explanations of numerical problems.

-

Exam-Oriented: Covers all NCERT questions, additional HOTS, and CBSE sample paper-based questions.

-

Visually Structured: Tables, formulas, and aggregates are neatly presented for easy understanding.

-

Prepared by Toppers: Created by CHK students who have excelled in Class 12 Economics.

Here’s the Solutions –

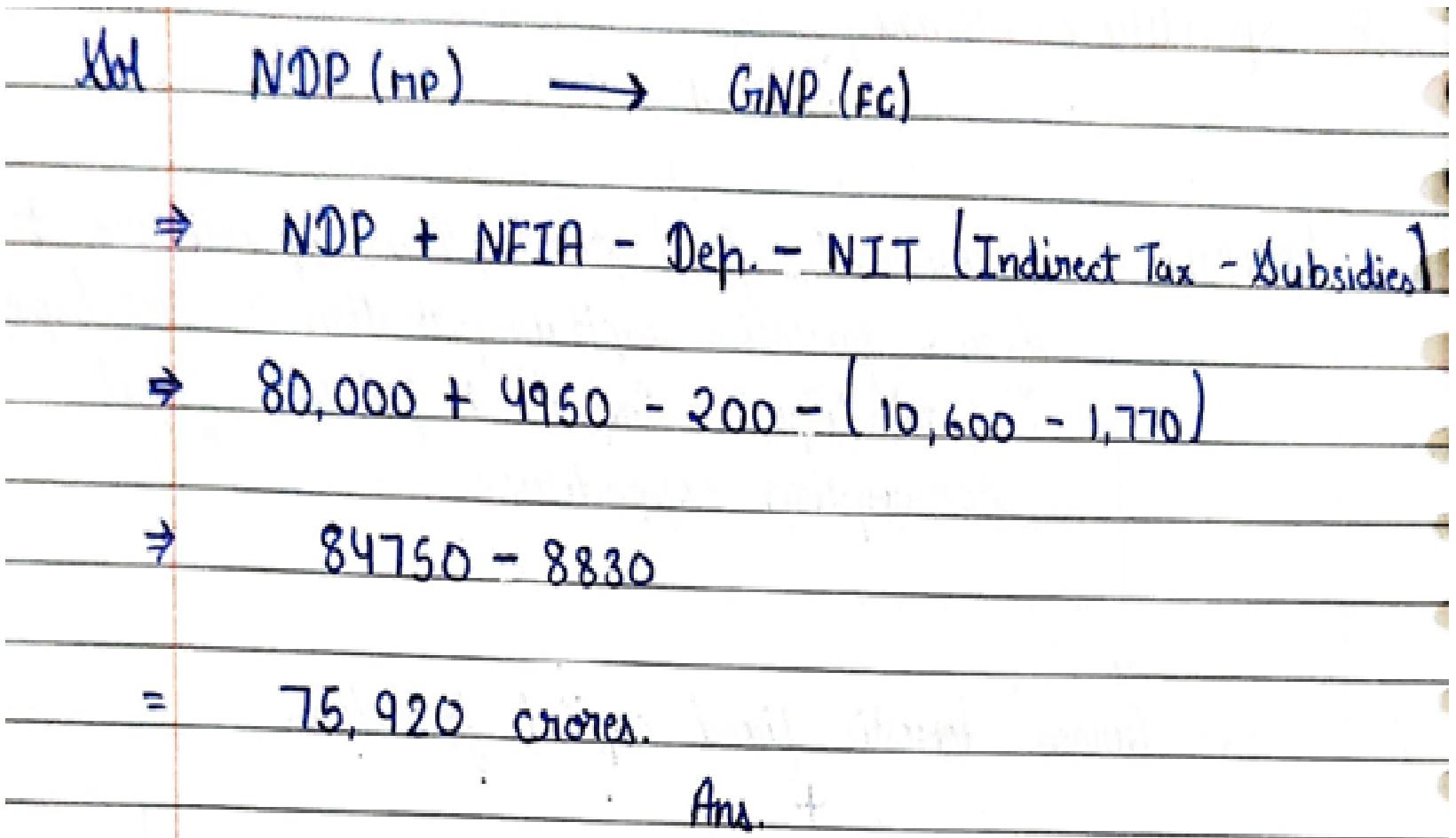

1. Calculate GNP at FC (Gross National Product at Factor Cost)

| Particulars | ₹ in crores |

| 1. NDP at MP | 80,000 |

| 2. Net Factor income from abroad | (-) 200 |

| 3. Deprecation | 4,950 |

| 4. Subsidies | 1,770 |

| 5. Indirect Tax | 10,600 |

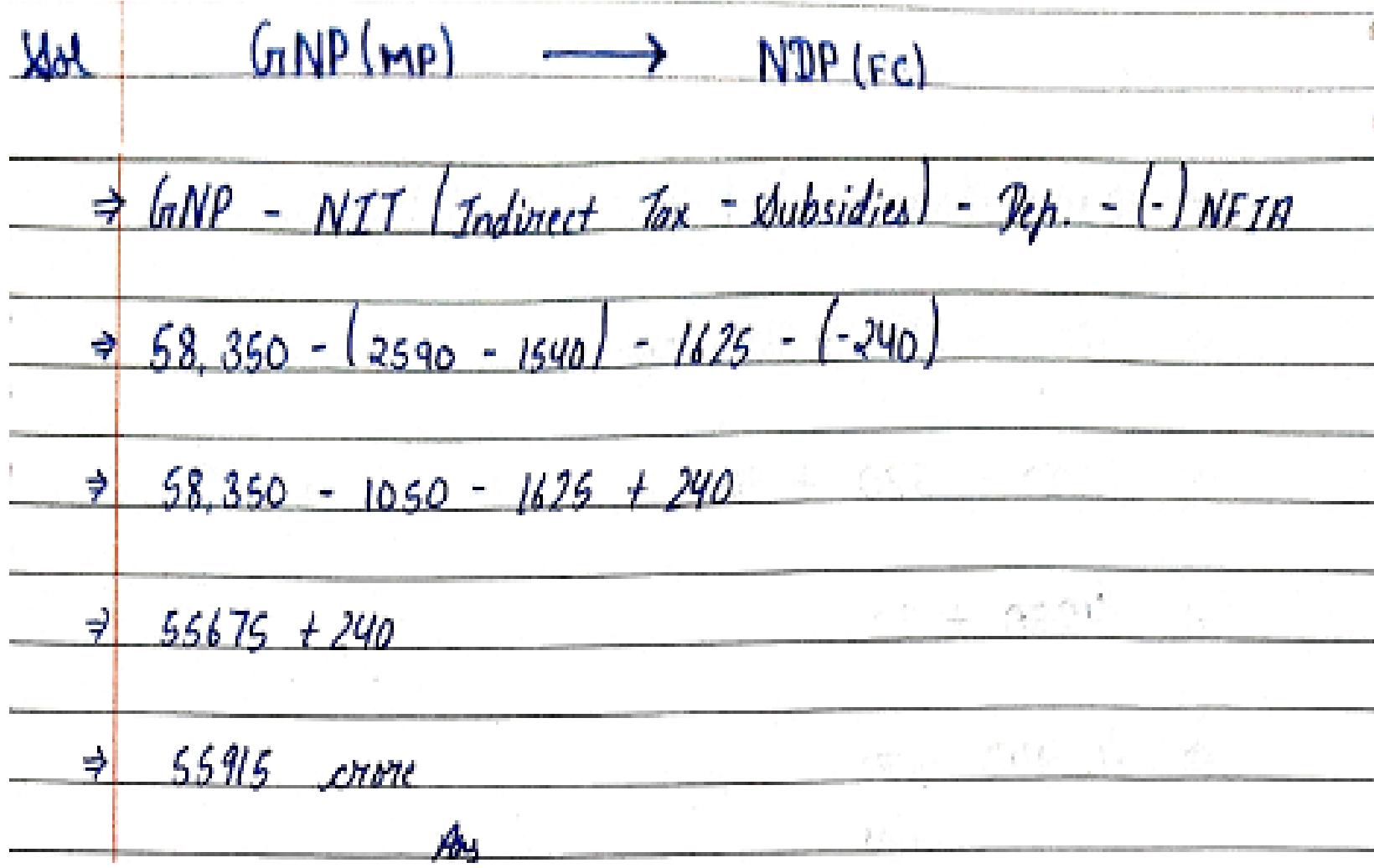

2. Calculate Domestic Income

| Particulars | ₹ in crores |

| 1. Gross National Product at market price | 58,350 |

| 2. Indirect tax | 2,590 |

| 3. Subsidies | 1,540 |

| 4. Depreciation | 1,625 |

| 5. Net Factor income from abroad | (-)240 |

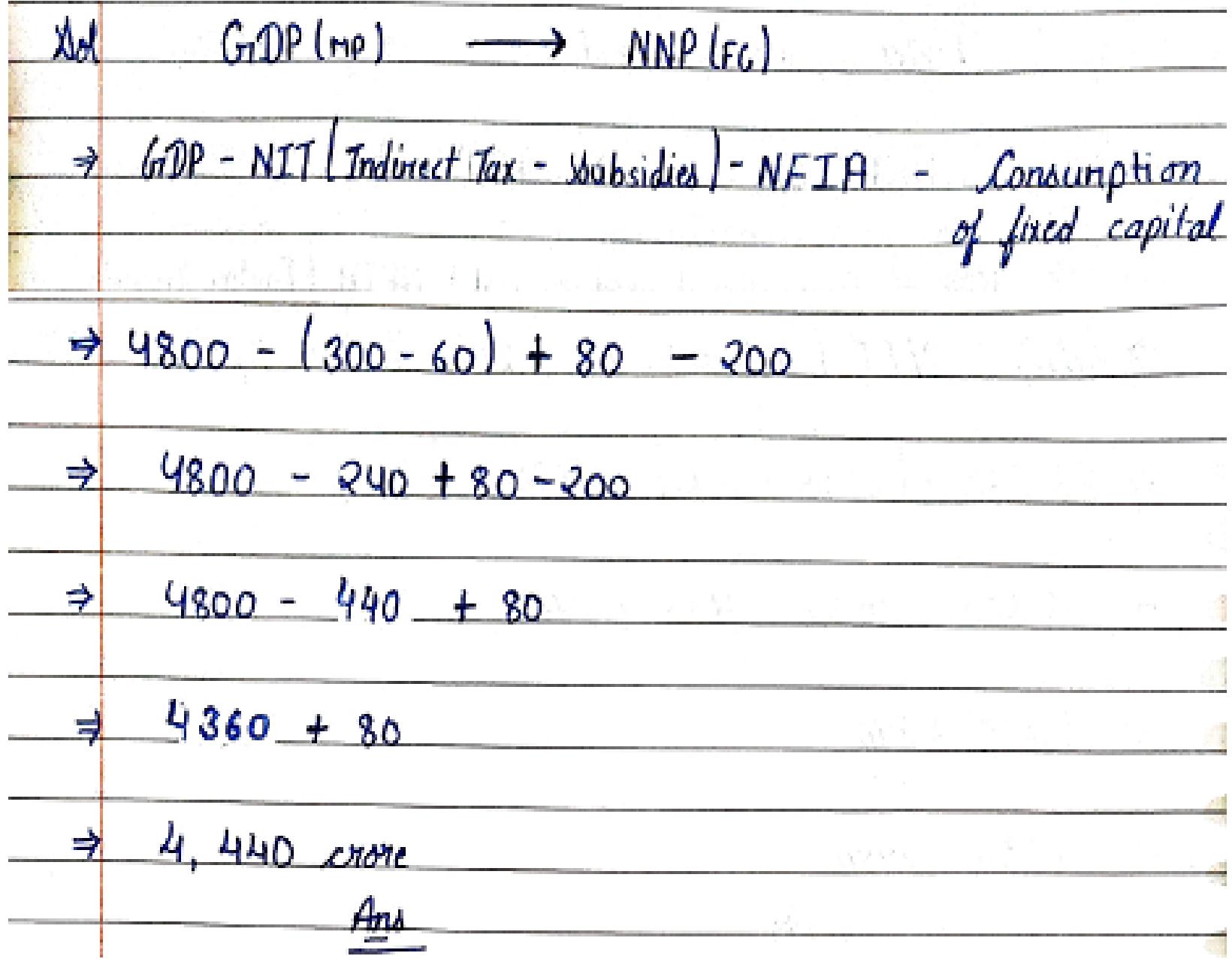

3. Calculate National Income or NNP at FC.

| Particulars | ₹ in crores |

| 1. GDP at MP | 4,800 |

| 2. Indirect Taxes | 300 |

| 3. Net Factor Income from aborad | 80 |

| 4. Consumption of fixed capital | 200 |

| 5. Subsidies | 60 |

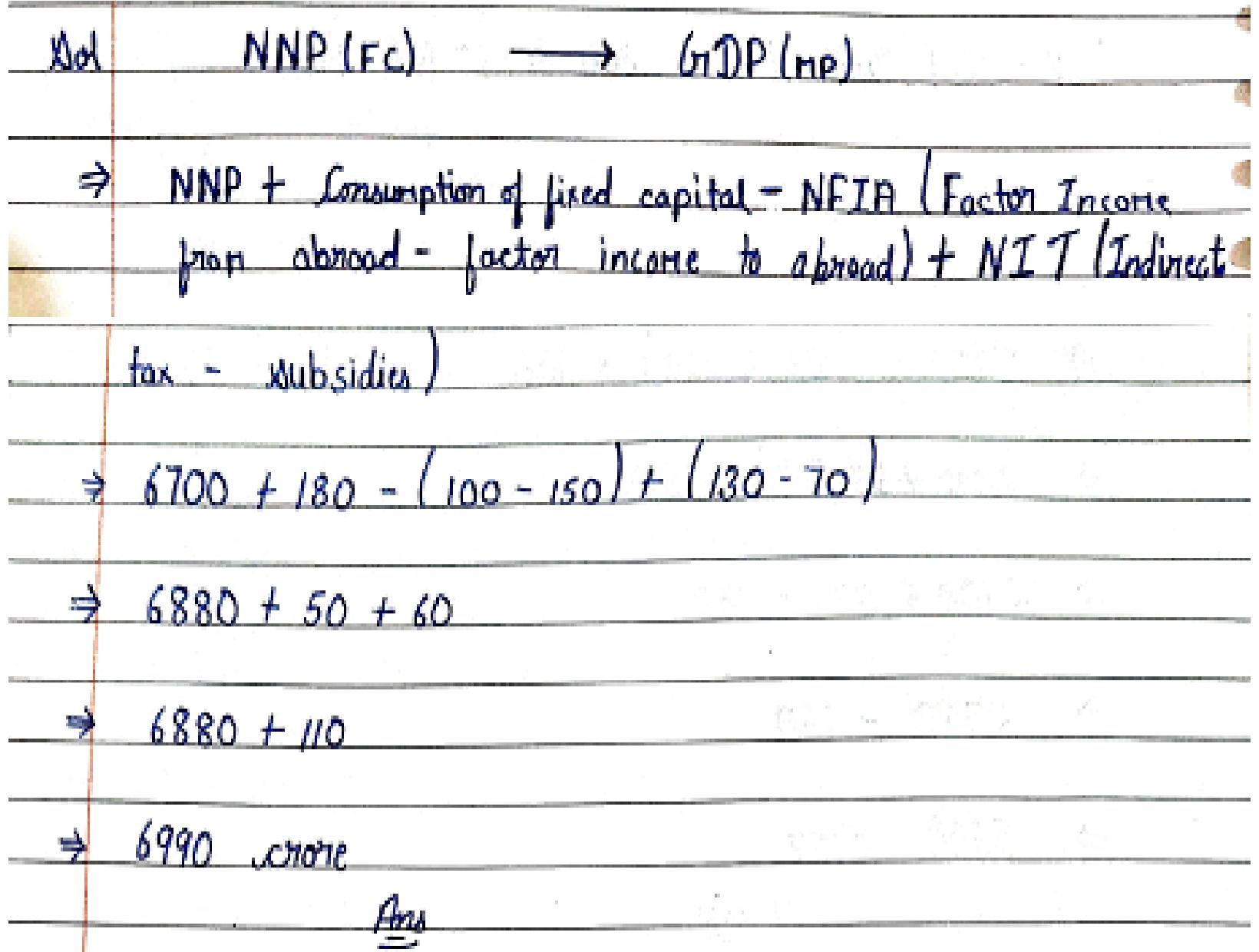

4. Calculate GDP at MP

| Particulars | ₹ in crores |

| 1. National Income | 6700 |

| 2. Consumption of fixed capital | 180 |

| 3. Factor income from aborad | 100 |

| 4. Indirect taxes | 130 |

| 5. Subsidies | 70 |

| 6. Factor income to abroad | 150 |

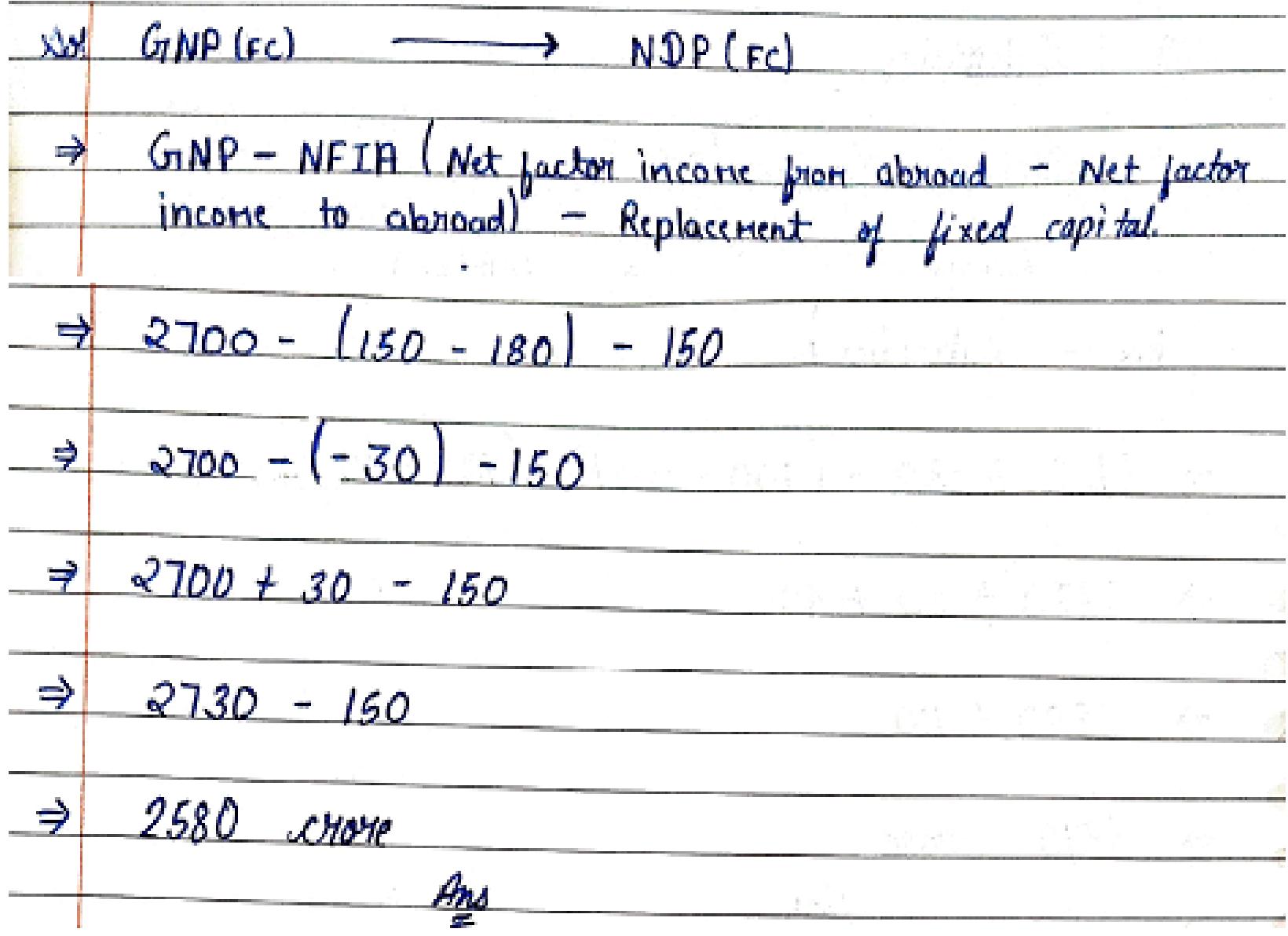

5. Calculate Domestic Income

| Particulars | ₹ in crores |

| 1. GNP at FC | 2700 |

| 2. Indirect taxes | 60 |

| 3. Factor income from abroad | 150 |

| 4. Factor income to abroad | 180 |

| 5. Replacement of Fixed Capital | 150 |

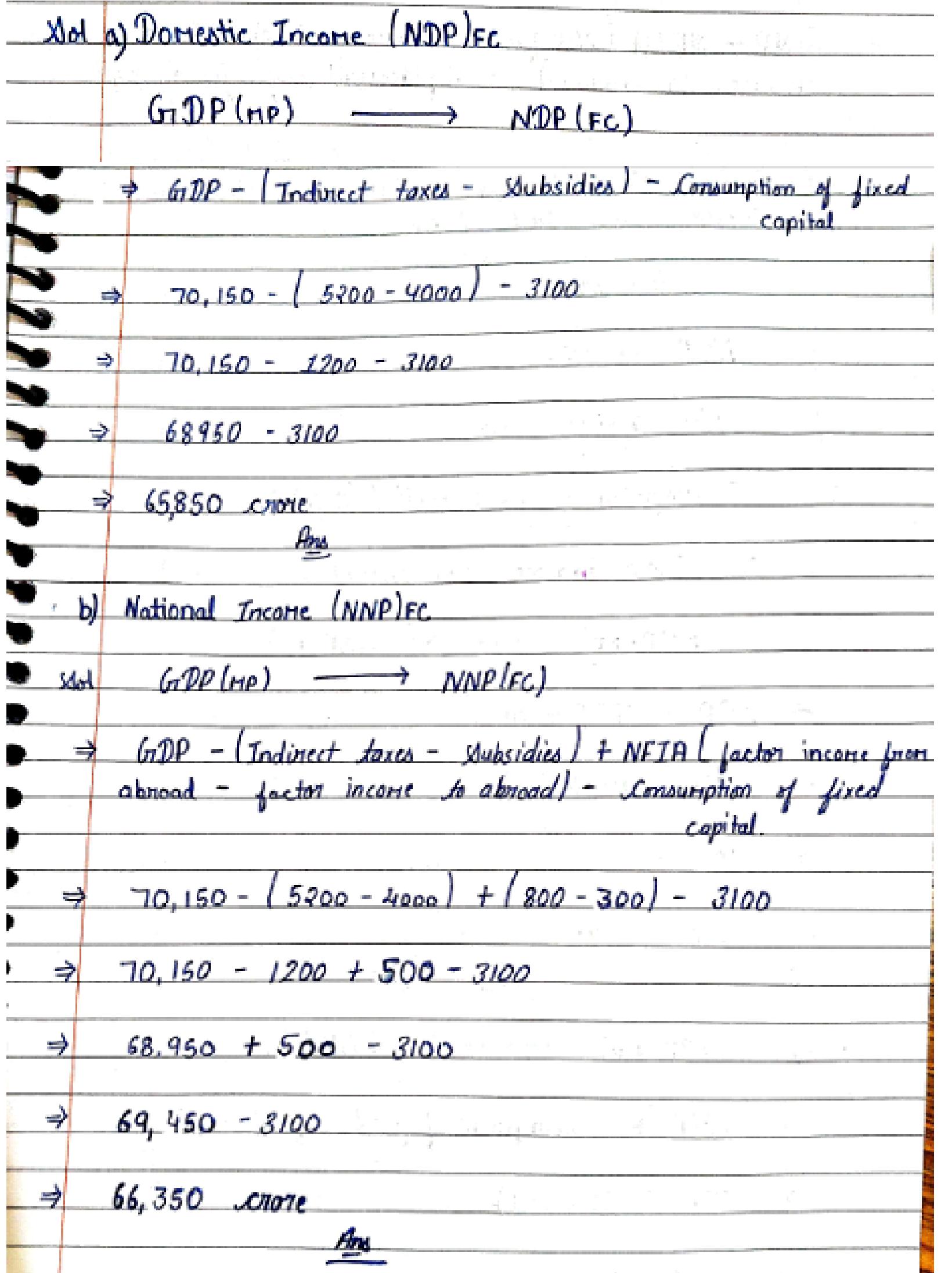

6. Calculate (a) Domestic Income, (b) National Income

| Particulars | ₹ in crores |

| 1. GDP at MP | 70150 |

| 2. Indirect taxes | 5200 |

| 3. Factor income from abroad | 800 |

| 4. Consumption of fixed capital | 3100 |

| 5. Factor income to abroad | 300 |

| 6. Subsidies | 4000 |

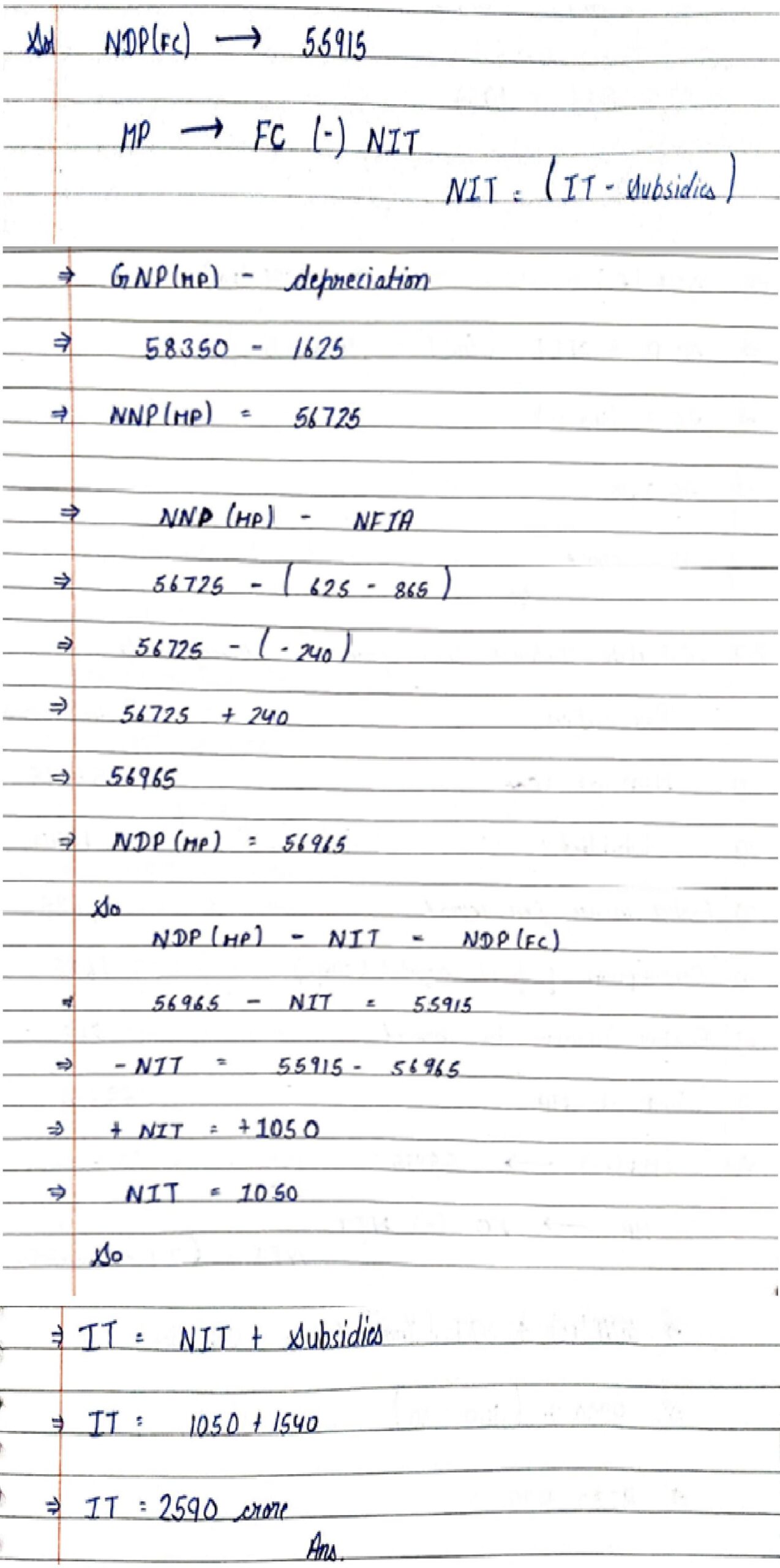

7. Calculate Indirect taxes from the following data:

| Particulars | ₹ in crores |

| 1. NDP at FC | 55915 |

| 2. Subsidies | 1540 |

| 3. Factor income from abroad | 625 |

| 4. Consumption of fixed capital | 1625 |

| 5. Factor income to abroad | 865 |

| 6. GNP at MP | 58350 |

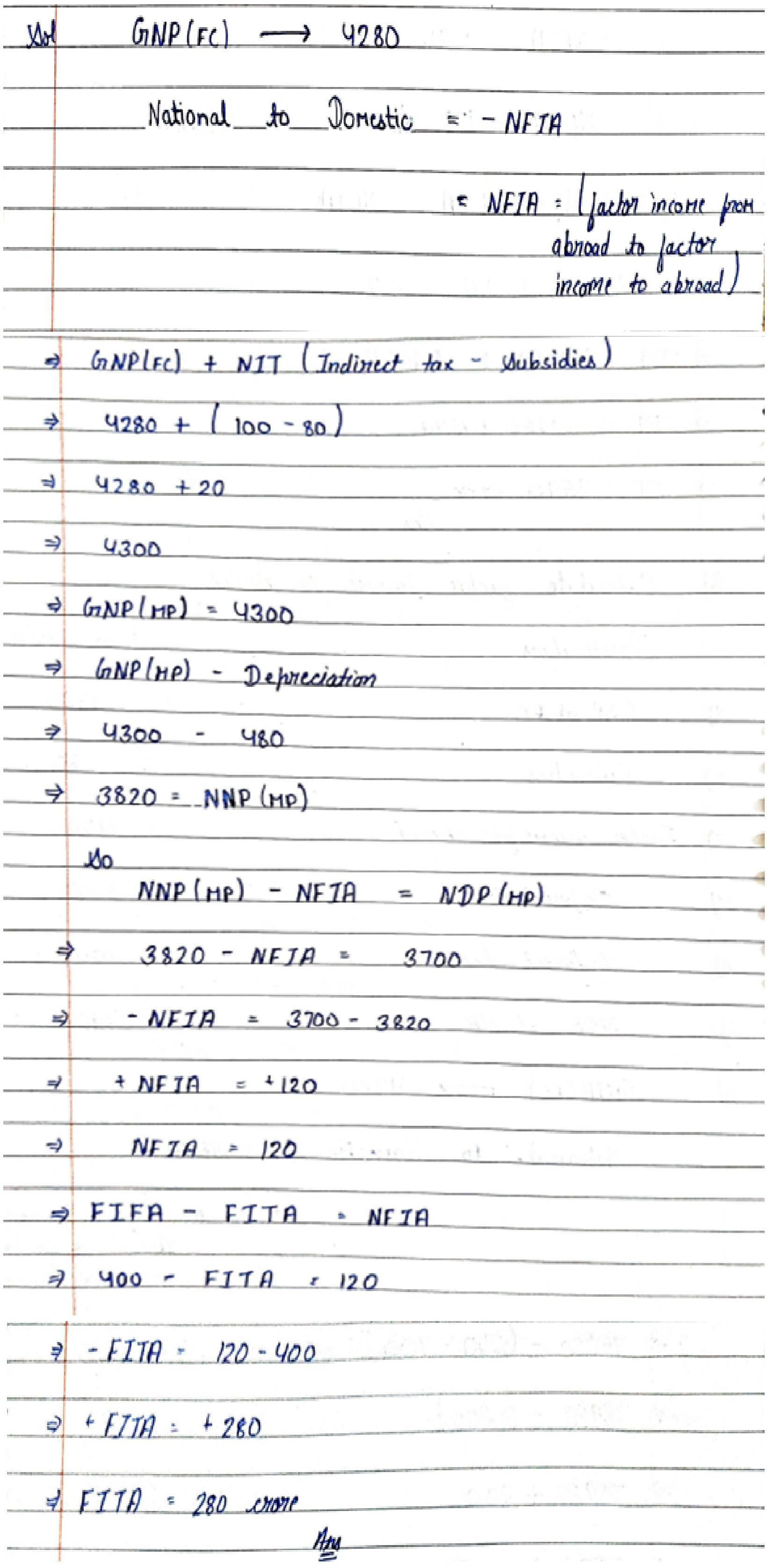

8. Calculate Factor income to abroad:

| Particulars | (₹ in crores) |

| 1. GNP at FC | 4280 |

| 2. Subsidies | 80 |

| 3. Factor income from abroad | 400 |

| 4. Depreciation | 480 |

| 5. Indirect taxes | 100 |

| 6. NDP at MP | 3700 |

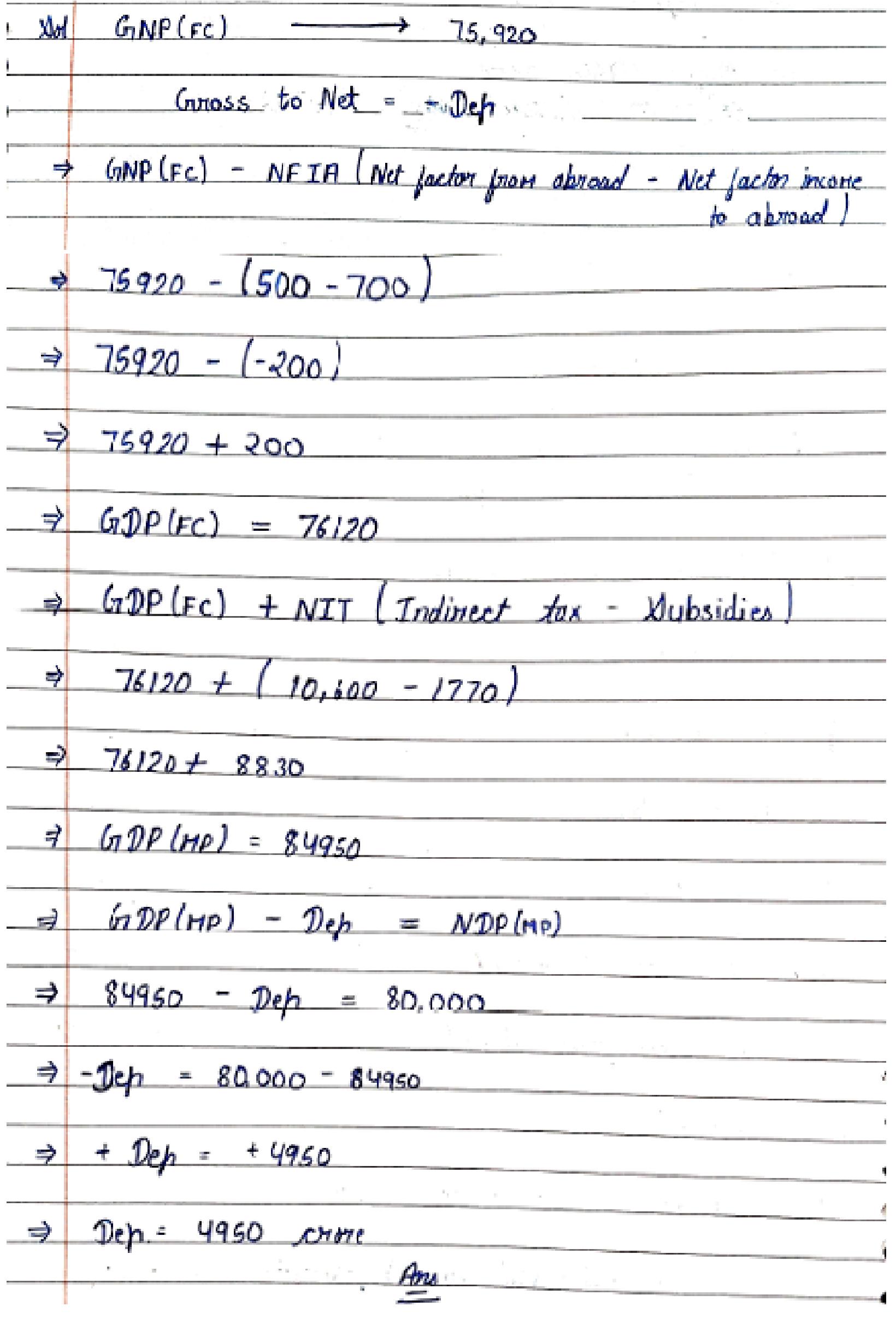

9. Calculate Depreciation:-

| Particulars | (₹ in crores) |

| 1. NDP at MP | 80,000 |

| 2. Indirect taxes | 10,600 |

| 3. GNP at FC | 75,920 |

| 4. Factor income to abroad | 700 |

| 5. Factor income from abroad | 500 |

| 6. Subsidies | 1770 |

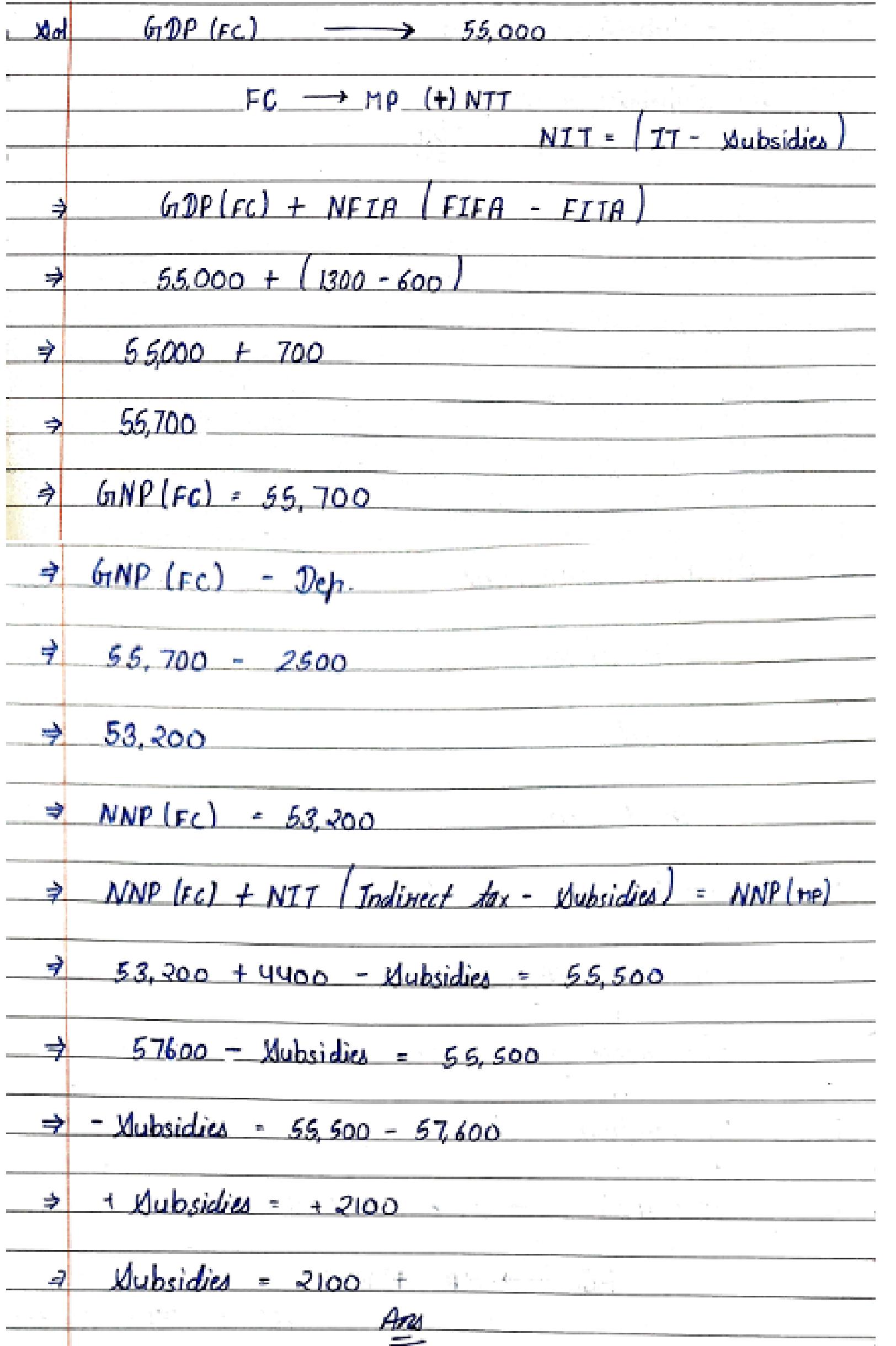

10. Calculate Subsidies:-

| Particulars | (₹ in crores) |

| 1. GDP at FC | 55,000 |

| 2. Indirect taxes | 4,400 |

| 3. Factor income to abroad | 600 |

| 4. NNP at MP | 55,500 |

| 5. Factor income from aborad | 1,300 |

| 6. Depreciation | 2,500 |

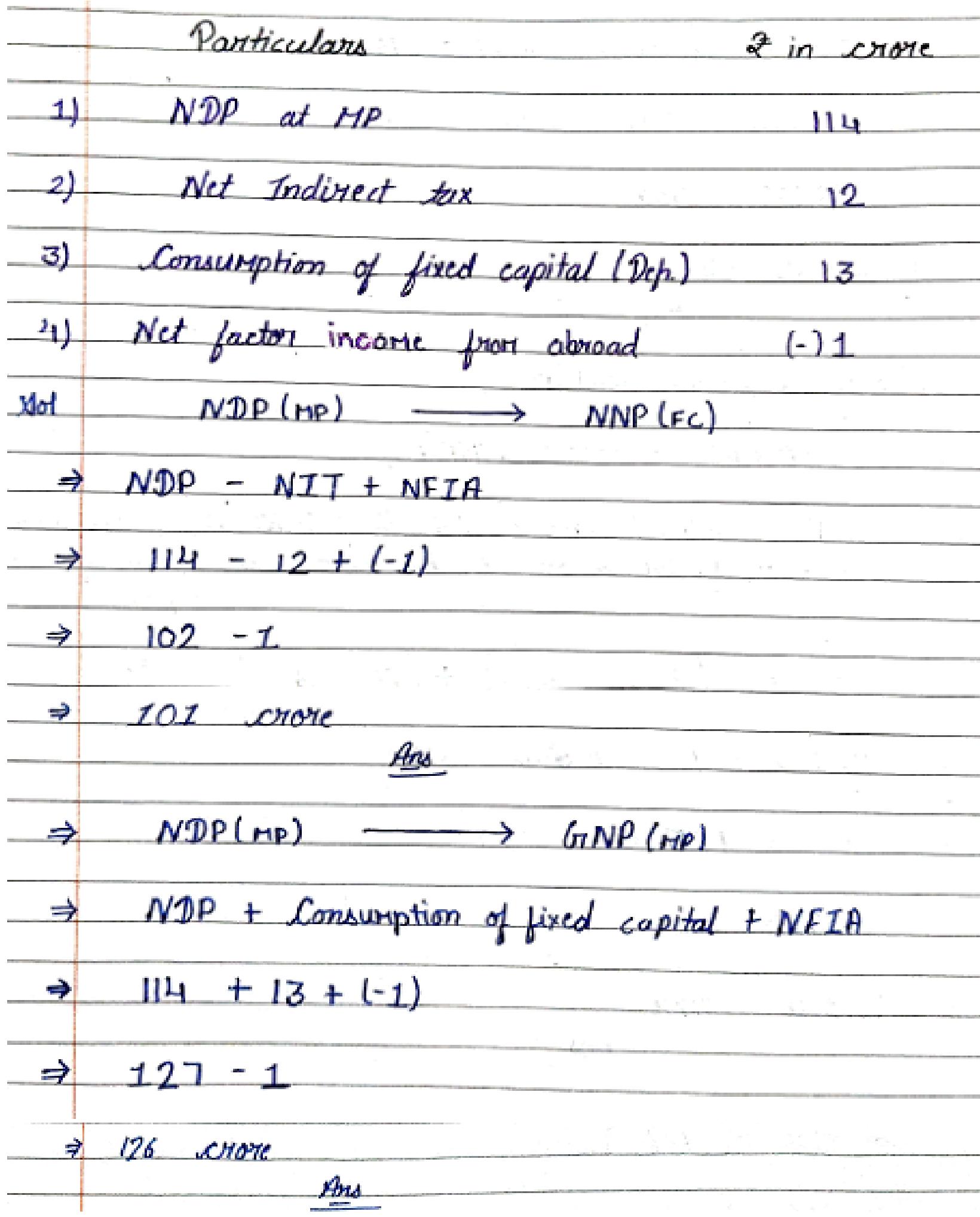

11. Given the following, calculate National Income and GNP at MP.

| Particulars | (₹ in crore) |

| 1. NDP at MP | 114 |

| 2. Net Indirect tax | 12 |

| 3. Consumption of fixed Capital | 13 |

| 4. Net factor income from abroad | (–)1 |

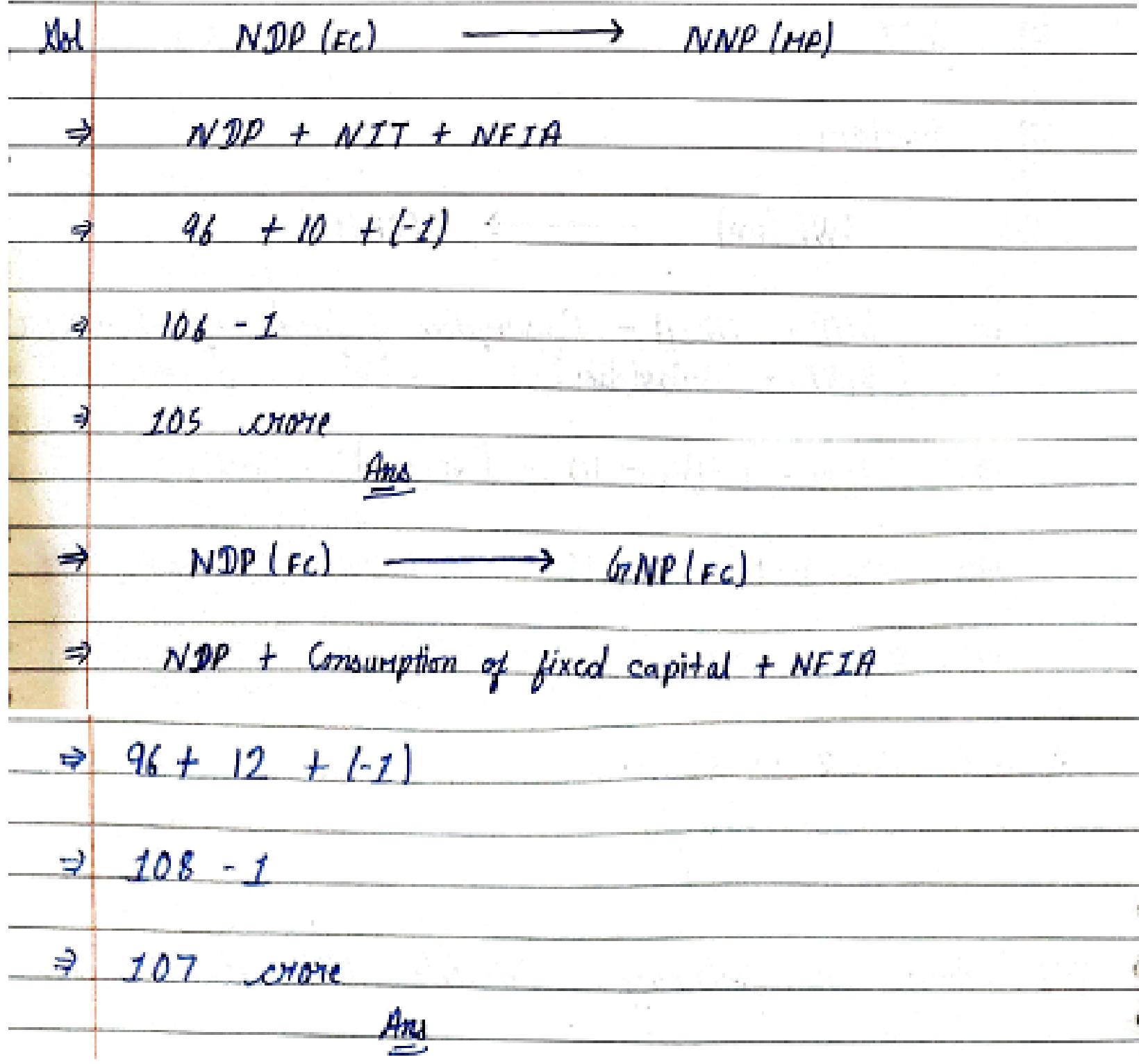

12. Given the following, calculate NNP at MP and GNP at FC.

| Particulars | (₹ in crore) |

| 1. NDP at FC | 96 |

| 2. Net indirect tax | 10 |

| 3. Consumption of fixed capital | 12 |

| 4. NFIA | (–) 1 |

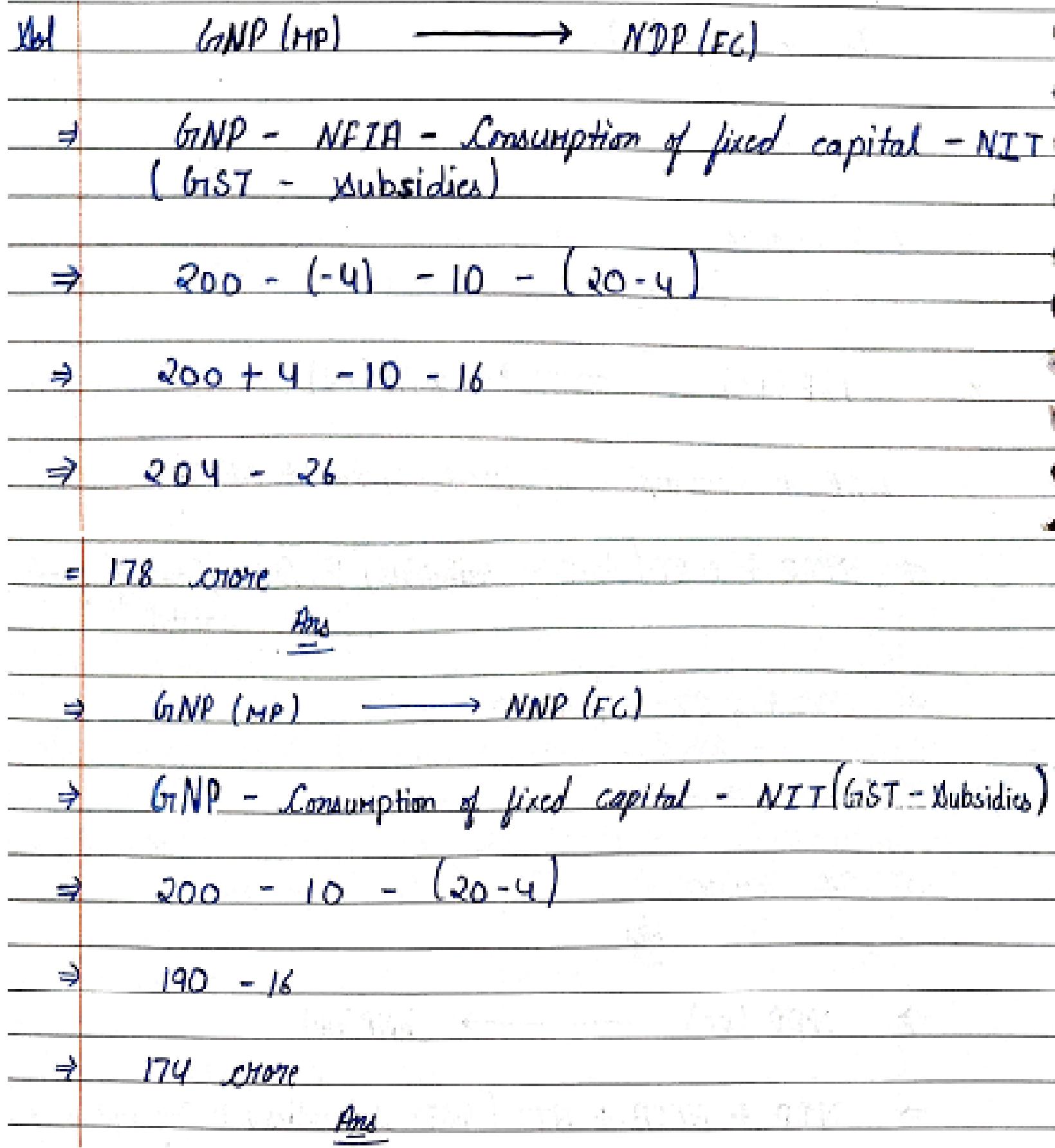

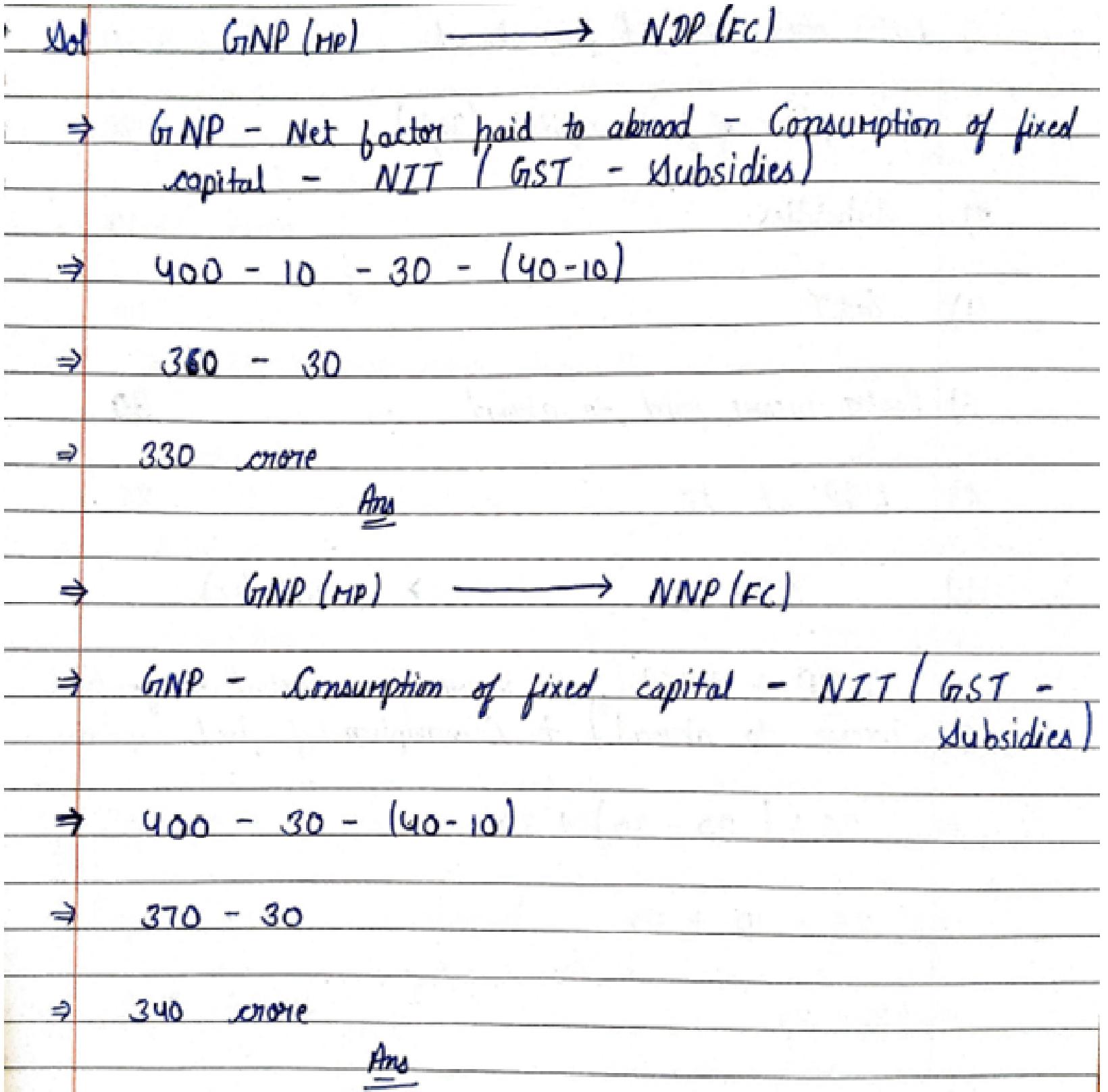

13. Calculate NDP at FC and NNP at FC

| Particulars | (₹ in crore) |

| 1. GNP at MP | 200 |

| 2. NFIA | (–) 4 |

| 3. Consumption of fixed capital | 10 |

| 4. GST | 20 |

| 5. Subsidies | 4 |

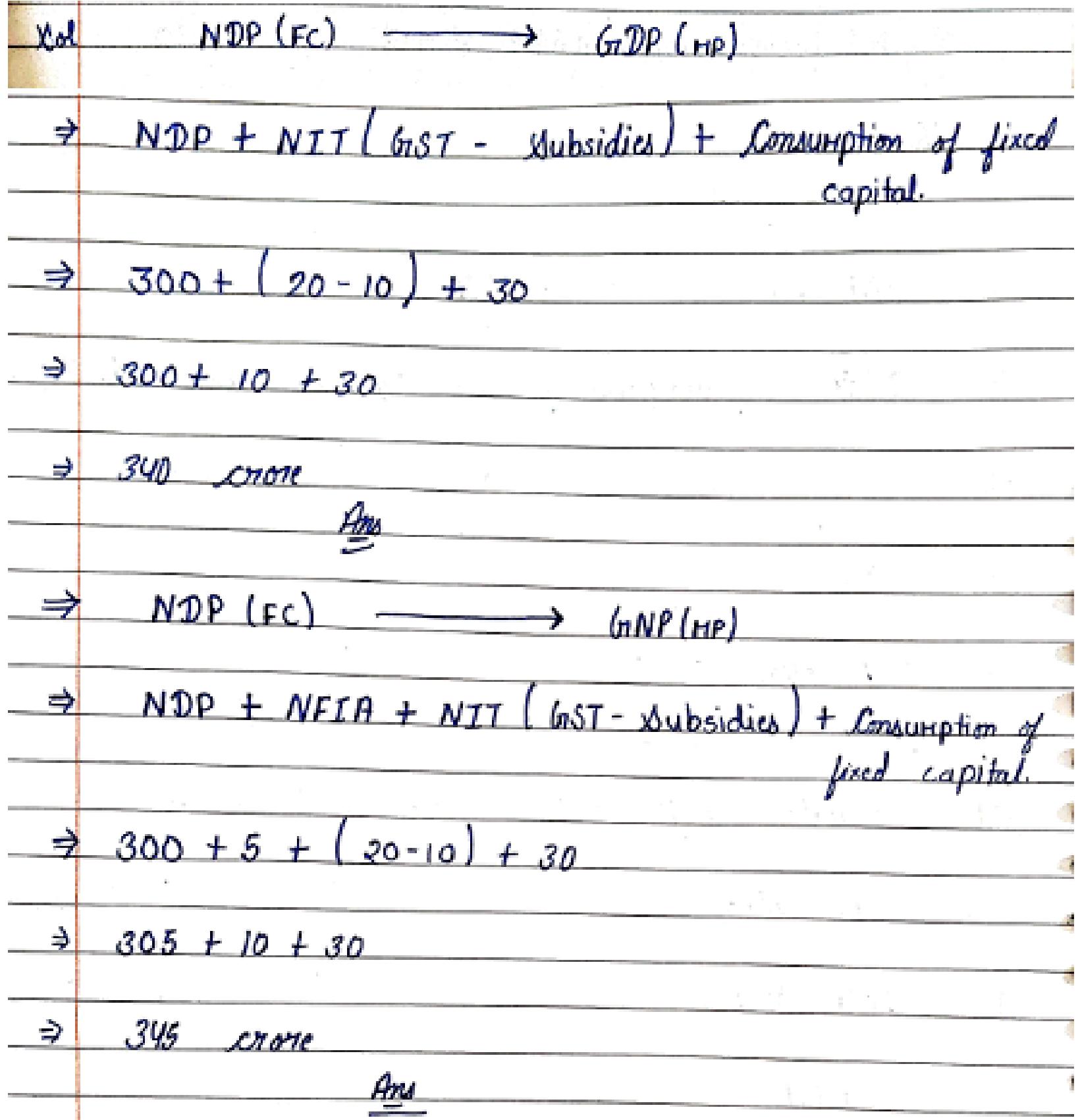

14. Calculate GDP at MP and GNP at MP.

| Particulars | (₹ in crore) |

| 1. NDP at FC | 300 |

| 2. NFIA | 5 |

| 3. GST | 20 |

| 4. Consumption of fixed capital | 30 |

| 5. Subsidies | 10 |

15. Calculate NDP at FC and National Income

| Particulars | (₹ in crore) |

| 1. GNP at MP | 400 |

| 2. Net factor income paid to abroad | 10 |

| 3. Consumption of fixed capital | 30 |

| 4. GST | 40 |

| 5. Subsidies | 10 |

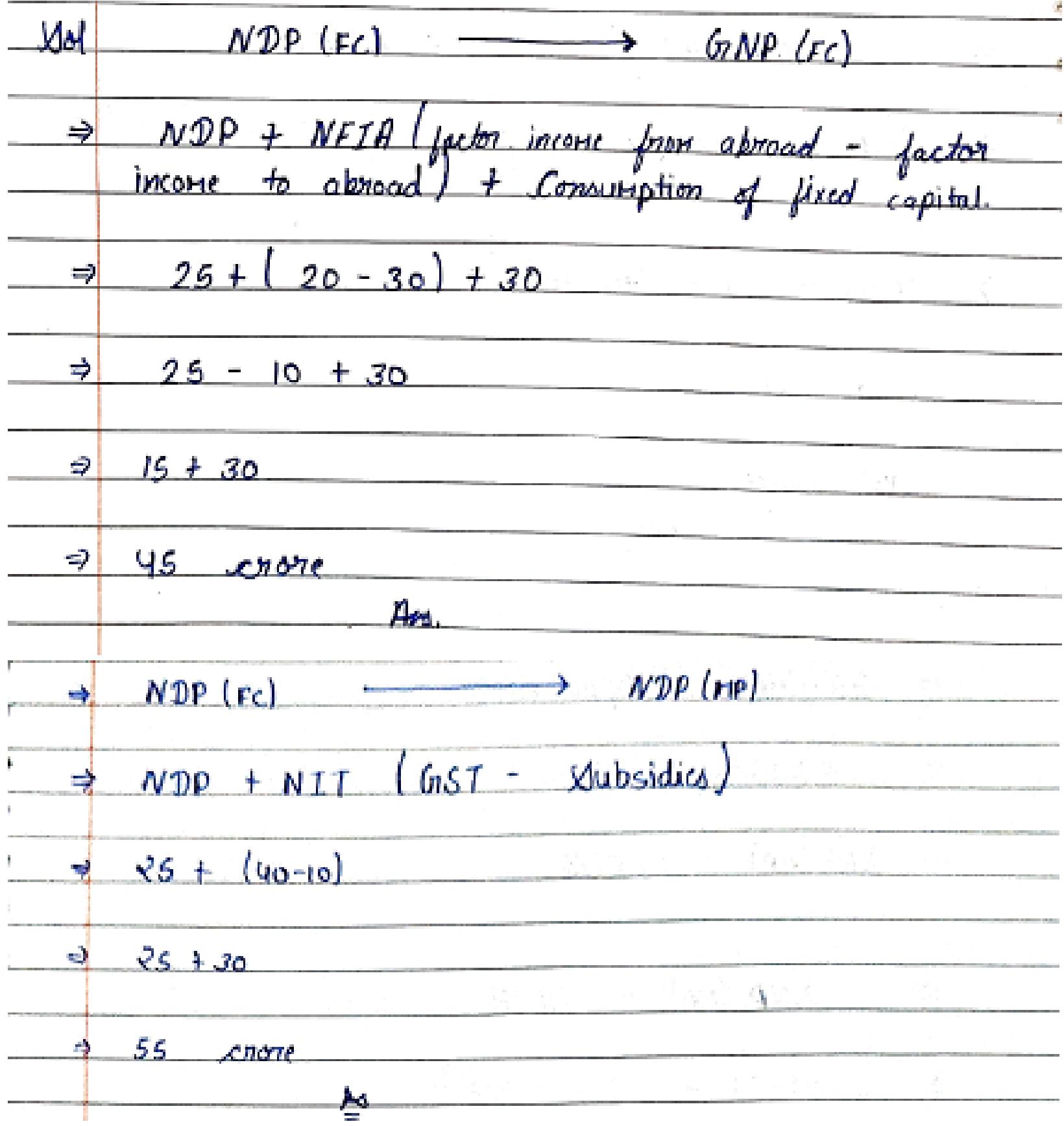

16. Calculate GNP at FC and NDP at MP

| Particulars | (₹ in crore) |

| 1. Factor income received from abroad | 20 |

| 2. Consumption of fixed capital | 30 |

| 3. Subsidies | 10 |

| 4. GST | 40 |

| 5. Factor income paid to abroad | 30 |

| 6. NDP at FC | 25 |

Tips for Students

- Always specify Market Price or Factor Cost when writing GDP, NDP, GNP, or NNP.

- Remember to subtract depreciation to move from Gross to Net values.

- Add or subtract Net Factor Income from Abroad carefully to shift between domestic and national aggregates.

-

Practice at least 5–6 numericals daily for speed and accuracy.

Also Download – Class 12 Income Method Solutions

Conclusion

Understanding National Income and Related Aggregates is the foundation of Class 12 Macroeconomics and plays a crucial role in developing a clear perspective on how an economy functions. By working through these solutions prepared by CHK Students, you get a structured approach to solving questions on GDP, GNP, NDP, and other key aggregates with accuracy.

These solutions not only help in board exam preparation but also build your conceptual clarity for higher studies in economics, commerce, and management. Keep revising regularly, practice numerical problems, and focus on the logic behind each concept — this will ensure you master this chapter with confidence.

for more information contact us –

Ph. No. – +91-6367885579

WhatsApp – Click to chat

facebook – @commercehubkota

Instagram – @comerc_classes

Youtube – @commercehubkota

Telegram – @comerc.in